In today’s highly competitive business environment, understanding the nuances of customer acquisition cost (CAC) is crucial.

However, it’s not all about CAC.

Other metrics play an equally important role in shaping your marketing strategy.

In this post, we’ll shed light on these critical metrics, and take a look at the metric that is more important than customer acquisition cost.

Understanding the Role of LTV and CAC

Many businesses fail to accurately determine the true lifetime value (LTV) of their customers. Instead, they tend to focus on customer acquisition cost (CAC), neglecting the importance of LTV and profitability.

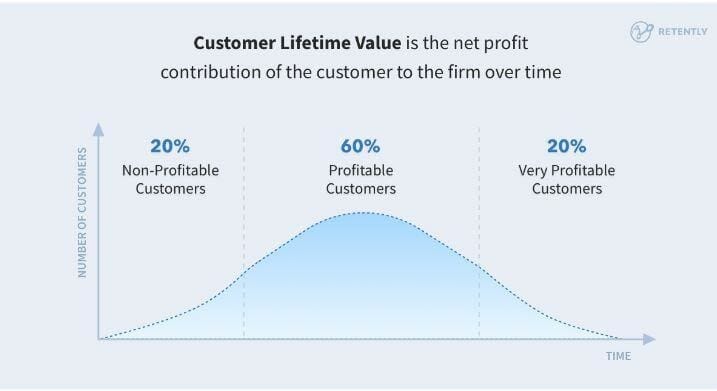

Lifetime Value (LTV) and Customer Acquisition Cost (CAC) are two vital metrics that businesses use to assess the profitability of their marketing funnel and sales efforts. Understanding both is crucial for effectively managing a company’s growth and profitability.

- Lifetime Value (LTV): This is the total net profit a company expects to make from a customer over the entire duration of their relationship. LTV takes into account all revenue that a customer will generate for a business, subtracting the costs associated with servicing that customer, such as the costs of goods sold, support and servicing. It’s a measure of the value a customer brings to a business over a longer time frame. The higher the LTV, the more valuable a customer is to the business.

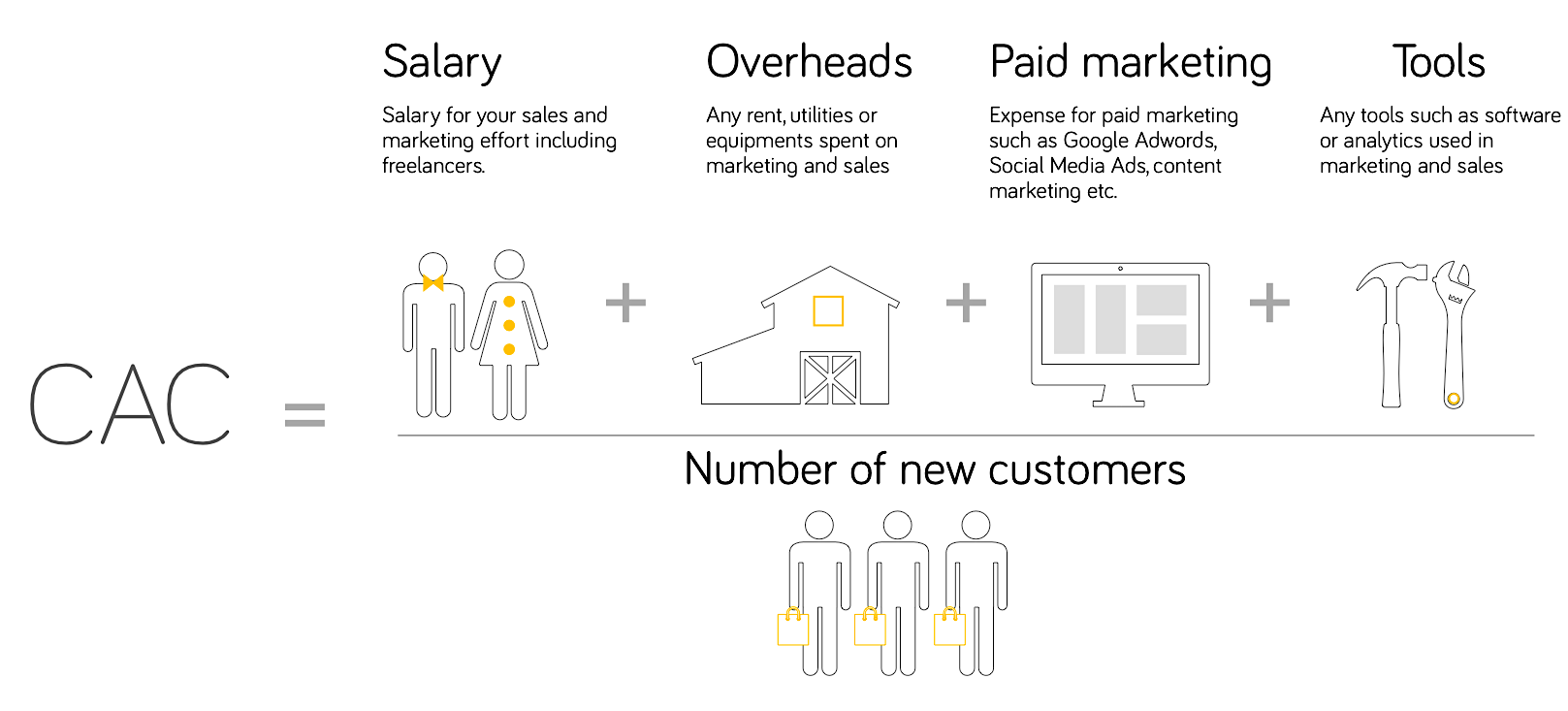

- Customer Acquisition Cost (CAC): This is the total cost of attracting and converting a customer. It includes all expenses related to marketing and sales (e.g., advertising costs, employee salaries, software tools) that are required to bring in new customers. The goal for any business is to keep CAC as low as possible without impacting the quality of the customers being acquired.

The relationship between LTV and CAC is important. Ideally, the LTV should be higher than the CAC, indicating that the value a customer brings to the business is greater than the cost to acquire them. If the CAC is higher than the LTV, the company may eventually run into cash flow issues as they are spending more to acquire customers than they are earning from them.

A healthy LTV/CAC ratio is often considered to be 3:1 or higher.

So focusing solely on CAC may sometimes lead you astray. This is why we think companies should pay more attention to LTV, which ultimately governs the overall marketing strategy.

Dive Deeper: How to Use UX Testing to Improve Your Customer Lifetime Value (CLV)

The Cost of Acquisition (CAC) Trap

An article by Elena Verna, titled “Cost of Acquisition, CAC Trap” states that concentrating solely on CAC is a misguided approach. Instead, companies should focus on the payback period.

An interesting example from the article compares two channels:

- Channel A generates a high volume of customers with a CAC of $5.

- Channel B brings in fewer customers but has a CAC of $1,000.

She says: “The immediate reaction of many would be to shut down Channel B due to its high CAC to reduce the average CAC.”

Surprisingly, despite its high CAC, Channel B might be more profitable as it attracts customers who convert to paid faster, recover their acquisition costs sooner, and contribute significant additional revenue.

Thus, focusing on lowering customer acquisition cost alone could close your most profitable channel in favor of attracting accounts with low intent and poor conversion rates. This is a critical point for businesses (especially SaaS businesses) looking for effective customer acquisition strategies.

Dive Deeper: SaaS CAC: A Guide to Customer Acquisition Costs

The Misconception About Low CAC and High Traffic

There is a caveat to this argument, which is that while low-cost acquisition typically brings in more traffic, the quality of this traffic can be poor. On the other hand, a higher CAC tends to attract better quality traffic. This is especially true for larger-scale marketing campaigns.

Remember, the primary objective of any business is not just to drive traffic, but to drive high-quality traffic that will convert into paying customers. Let’s take a closer look at the relationship between Customer Acquisition Cost (CAC) and the quality of traffic.

Low CAC and High Traffic

Often, strategies that aim for a low CAC attract a high volume of traffic. These might include broad-targeted online advertising, viral marketing or mass-market media campaigns. While these strategies can result in significant visibility and high numbers of potential customers, they often lack specificity and targeted focus.

Consequently, the traffic generated through these channels can be of lower quality, meaning it may have a lower conversion rate, less engagement or lower customer lifetime value. This is because these strategies might attract a lot of people who are less interested in your product or less likely to convert into paying customers.

- For example, a company might spend a small amount on a broad social media advertising campaign that results in a large number of visits to their website, but few of these visitors might actually make a purchase or become long-term customers.

High CAC and Quality Traffic

On the other hand, strategies that result in a higher CAC often target more specific, interested audiences and therefore may attract higher quality traffic. These could be strategies like targeted online advertising, SEO for niche keywords, or focused content marketing.

While these strategies may result in lower overall traffic numbers, the traffic they do generate is often more valuable to the business. This is because the people attracted through these channels are more likely to have a strong interest in your product or service and are therefore more likely to convert into paying customers and provide a higher lifetime value.

- For example, a business might spend more on a highly targeted Google Ads campaign that attracts fewer overall website visitors, but these visitors may be more likely to make a purchase and become repeat customers.

Balancing CAC and Traffic Quality

The key is to find the balance between CAC and traffic quality that works best for your specific business and goals. It’s essential to remember that not all traffic is created equal, and businesses must strive to attract visitors who are likely to convert and provide high lifetime value.

At scale, a high CAC may result in higher-quality traffic, while initially many channels might have high CAC and terrible traffic. It is therefore crucial to examine the payback period when evaluating the effectiveness of your acquisition channels.

Related Content: How to Conduct Smart Competitor Research for Better Customer Acquisition

The Significance of Payback Period

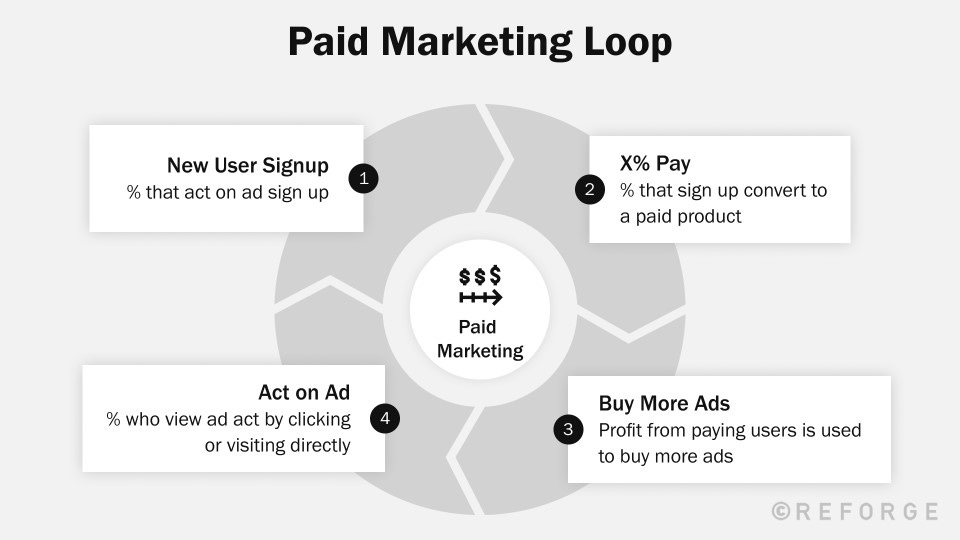

This leads to the concept of the “paid marketing loop.” Essentially, the payback period measures how quickly you can recoup your acquisition costs and reinvest the returns into the paid acquisition loop:

The payback period measures how quickly you can recoup your acquisition costs and reinvest the returns into the paid acquisition loop. If you’re attracting high-quality traffic, even at a higher CAC, you’ll likely see a shorter payback period because those customers are converting and generating revenue more quickly.

On the flip side, if you have a low CAC but are bringing in low-quality traffic, your payback period may be longer because those customers aren’t converting as quickly or as frequently.

That’s why it’s crucial to evaluate your acquisition channels not just based on CAC or traffic volume, but also on the quality of traffic and the subsequent payback period.

You should evaluate LTV on a channel-specific basis.

Some channels might bring in a higher LTV than others, allowing you to spend more on acquiring customers through those channels.

In contrast, the payback period is less crucial for large companies with substantial cash reserves. For smaller companies, however, the payback period can significantly impact cash flow, which makes it an important metric to monitor.

Related Content: Is YouTube a Good Source for Organic Customer Acquisition?

Conclusion: Scaling Your Marketing the Right Way

The key to successfully scaling your marketing lies in understanding your LTV and being patient with your payback period. Seven-figure companies typically want instant profitability, while eight-figure companies aim to break even, knowing that they’ll earn more due to LTV.

On the other hand, nine-figure companies are willing to lose money upfront because they understand their customer’s LTV and know they will profit in the long run. To build a larger business, focus on improving your LTV, user experience, and product or service flow. This is where the real growth happens.

In summary, understanding your CAC, LTV and payback period can help you make strategic decisions that will fuel your company’s growth. Remember, optimizing your customer acquisition strategy is not just about achieving a low CAC. It’s about understanding your customer’s value over time and working to increase that value.

If you’re ready to level up your business and get more customers, Single Grain’s digital marketing experts can help!👇