How to Optimize Crypto Payment Funnels for Revenue Growth

Businesses implementing crypto payment funnels are seeing transaction fees drop to just 1% compared to traditional payment rails, averaging 2.9% plus fixed costs. More importantly, BitPay merchants paid an average 1% processing fee per crypto transaction in 2024, while simultaneously expanding their customer base to include the growing segment of digital-native consumers.

For marketing executives and business leaders, crypto payment funnels represent more than just an alternative checkout option. They’re a strategic advantage that can drive measurable revenue growth while reducing operational costs. One-third of small businesses already accept crypto payments as of 2025, but the question isn’t whether to implement these systems, but how to optimize them for maximum business impact.

Key Takeaways

- Crypto payment funnels reduce transaction costs by up to 65% with processing fees averaging just 1% compared to traditional payment rails at 2.9% plus fixed costs, delivering immediate bottom-line impact.

- Four-stage optimization approach drives measurable conversion improvements by addressing specific friction points in discovery, wallet integration, transaction execution, and retention phases, with some companies achieving 56% conversion rate increases.

- Stablecoin integration addresses the primary user concern of price volatility, as these digital assets accounted for 35.5% of all crypto payment transactions in 2024, making funnels more accessible to mainstream customers.

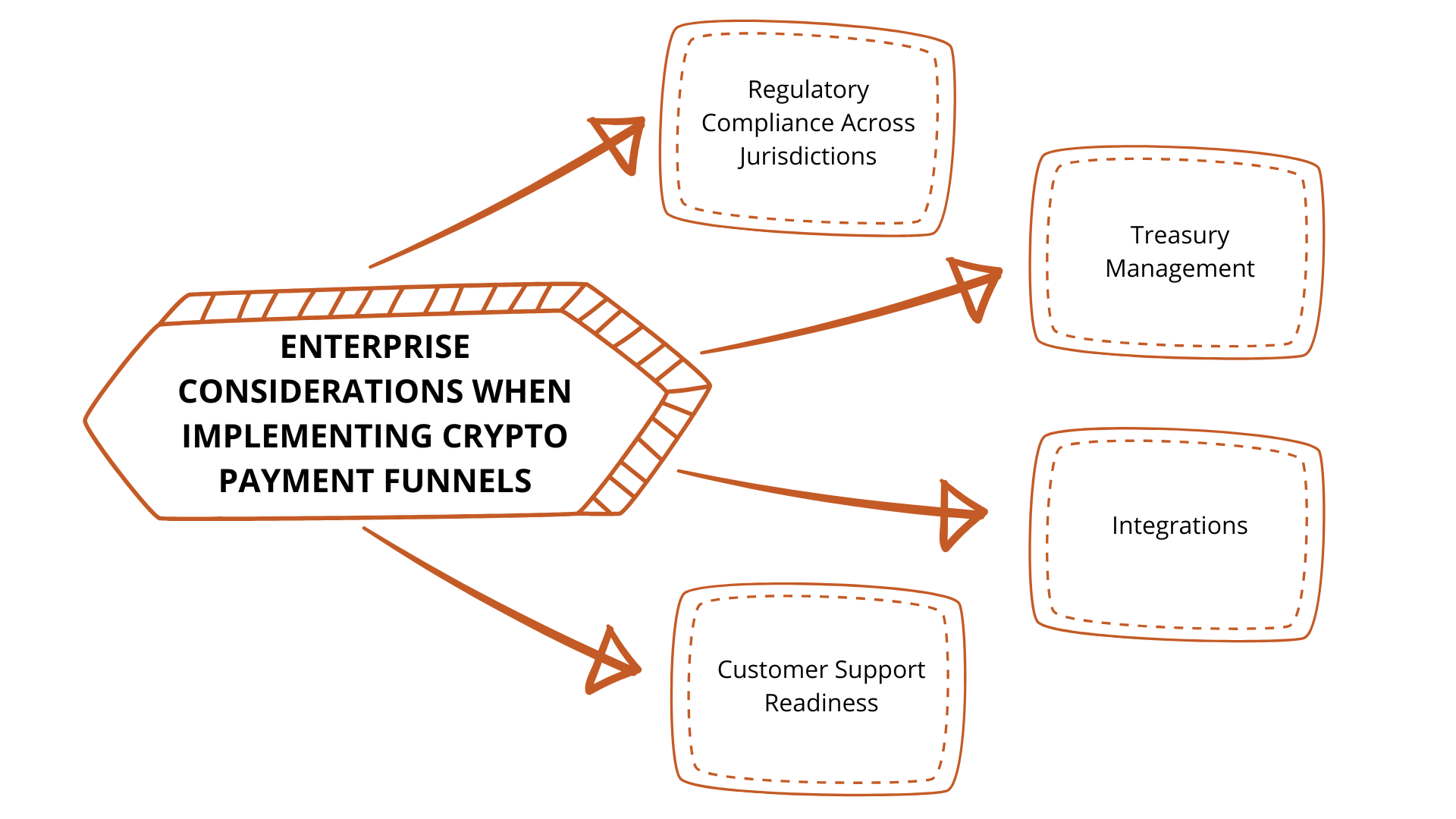

- Enterprise implementations require comprehensive compliance and integration planning, including regulatory adherence across jurisdictions, treasury management for volatility risk, and seamless connection with existing CRM and accounting systems.

- Success measurement extends beyond traditional metrics to include crypto-specific KPIs such as wallet activation rates, transaction confirmation success rates, and geographic expansion metrics that reveal unique optimization opportunities.

TABLE OF CONTENTS:

Understanding Crypto Payment Funnel Architecture

Unlike traditional payment funnels that rely on card networks and banks, crypto payment funnels operate on blockchain infrastructure, creating unique opportunities for optimization. The architecture consists of four critical stages: discovery, wallet integration, transaction execution, and retention. Each stage presents distinct challenges and opportunities for conversion optimization.

The discovery phase requires educating users about crypto payment benefits without overwhelming them with technical complexity. Research shows that stablecoins accounted for 35.5% of all crypto payment transactions processed by CoinGate in 2024, indicating that price stability remains a primary concern for users entering these funnels.

| Funnel Stage | Primary Challenge | Optimization Focus | Success Metric |

|---|---|---|---|

| Discovery | Technical complexity perception | Educational content, clear benefits | Click-through rate to payment options |

| Wallet Integration | Authentication friction | One-click connectors, progressive onboarding | Wallet activation rate |

| Transaction Execution | Volatility concerns, confirmation anxiety | Real-time pricing, status transparency | Transaction completion rate |

| Retention | Single-use behavior | Rewards programs, seamless repeat purchases | Repeat purchase rate |

Proven Strategies for Conversion Optimization

The most successful crypto payment funnel implementations focus on removing friction while maintaining security and compliance. AstroPay’s experience demonstrates the power of data-driven optimization: conversion rates in their crypto purchase funnel increased by 56% after UX and messaging fixes. The key was identifying specific abandonment points through funnel analysis and addressing them systematically.

“Detailed, data-driven funnel diagnostics can unlock double-digit conversion lifts for crypto payments by eliminating friction at the most common abandonment points. The challenge isn’t technical. It’s understanding user behavior and responding with targeted solutions.”

Successful optimization requires addressing three critical friction points: wallet connection complexity, price volatility concerns, and transaction confirmation anxiety. Companies like NordVPN have successfully tackled these challenges by integrating crypto payment gateways that enable customers worldwide to pay with Bitcoin, stablecoins, and other digital assets, resulting in a rapid expansion of international subscriptions and improved checkout satisfaction.

Enterprise Implementation Considerations

For enterprise-level implementations, the focus shifts from basic functionality to scalability, compliance, and integration with existing systems. The SaaS sector has seen particularly strong results, with companies like Radom demonstrating how automated crypto billing platforms can deliver up to 5× time savings on invoicing tasks and measurable churn reduction through streamlined payment collection processes.

Key enterprise considerations include:

- Regulatory compliance across jurisdictions: Different markets have varying requirements for KYC/AML procedures and crypto payment processing.

- Treasury management: Implementing hedging strategies to manage risk while maintaining operational efficiency.

- Integrations: Ensuring a seamless connection with existing CRM, accounting, and payment processing systems.

- Customer support readiness: Training teams to handle crypto-specific customer inquiries and technical issues.

The most successful enterprises treat crypto payment funnels as part of a broader digital transformation strategy, not just an additional payment method. This approach allows them to leverage comprehensive blockchain marketing strategies that align with their overall growth objectives.

Measuring ROI and Performance Metrics

Traditional payment funnel metrics need adaptation for crypto environments. Beyond standard conversion rates, track wallet activation rates, transaction confirmation success rates, and crypto-specific retention metrics. These advanced analytics reveal optimization opportunities that conventional payment analysis might miss.

The financial impact extends beyond direct transaction savings. Companies report reduced chargeback rates, faster international settlement, and access to previously underserved markets. When combined with strategic marketing funnel optimization, these benefits can drive significant revenue growth and market expansion.

Measuring performance should focus on business outcomes rather than technical metrics. Key performance indicators include customer acquisition cost reduction, lifetime value improvements, and geographic expansion metrics. These business-focused measurements help justify investment and guide optimization efforts.

Building Future-Ready Payment Infrastructure

As crypto payments evolve, forward-thinking organizations are building infrastructures that can adapt to emerging technologies and regulatory changes. This includes implementing flexible gateway solutions, maintaining compliance readiness, and staying current with user experience best practices. The convergence of AI, blockchain technology, and payment processing creates new opportunities for personalization and automation. Companies that establish strong crypto payment funnel foundations now will be better positioned to capitalize on these technological advances and maintain better security practices.

It can be challenging to adopt crypto payment funnels that integrate with your existing gateway, are scalable, and offer compliance. Work with the leading cryptocurrency marketing agency to develop a comprehensive strategy that integrates crypto payment funnels with your broader growth objectives.

Ready to turn those 2.9% processing fees into a competitive advantage?

Frequently Asked Questions

-

What are the typical cost savings when switching from traditional payment processing to crypto payment funnels?

Crypto payment funnels can reduce transaction costs by up to 65%, with processing fees averaging just 1% compared to traditional payment rails at 2.9% plus fixed costs. This translates to immediate bottom-line impact and significant cost savings for businesses processing high transaction volumes.

-

What are the four critical stages of crypto payment funnel optimization?

The four stages are discovery (educating users about benefits), wallet integration (streamlining authentication), transaction execution (addressing volatility concerns), and retention (encouraging repeat purchases). Each stage presents unique challenges that require targeted optimization strategies to maximize conversions.

-

How do stablecoins address customer concerns about crypto payment volatility?

Stablecoins accounted for 35.5% of all crypto payment transactions in 2024 because they maintain price stability by being pegged to traditional currencies. This makes crypto payments more accessible to mainstream customers who are concerned about price fluctuations during transactions.

-

What enterprise-level considerations are essential for successful crypto payment implementation?

Key considerations include regulatory compliance across different jurisdictions, treasury management, seamless integration with existing CRM and accounting systems, and customer support team training. Enterprises should treat crypto payments as part of a broader digital transformation strategy rather than just an additional payment method.

-

Which metrics should businesses track to measure crypto payment funnel performance?

Beyond traditional conversion rates, businesses should track wallet activation rates, transaction confirmation success rates, and crypto-specific retention metrics. Business-focused KPIs like customer acquisition cost reduction, lifetime value improvements, and geographic expansion metrics provide better insights for optimization.

-

How can businesses reduce friction in the wallet integration stage?

Implement one-click wallet connectors and progressive onboarding processes to minimize authentication friction. Focus on removing technical complexity while maintaining security, as this stage often represents the biggest barrier to conversion in crypto payment funnels.

-

What regulatory compliance requirements should businesses consider when implementing crypto payments?

Compliance requirements vary significantly across jurisdictions and typically include KYC/AML procedures specific to crypto transactions, as well as filing financial reports and routine auditing. Businesses need to ensure they meet local regulations in each market where they accept crypto payments and maintain compliance readiness as regulations continue to evolve.