If you listen to the Marketing School podcast, you’ve probably heard Neil and me talking about various Marketing School events we hosted over the years. In fact, you may have noticed that a lot of brands are jumping on the live event bandwagon.

But is it really worth it? What does the ROI look like for throwing a live event, versus putting your marketing dollars into other channels?

The answer, of course, is… it depends. The final ROI for your event comes down to several factors, including your ticket costs, any fees you raise from sponsors, your upsells on the backend and even outright selling your conference.

Let’s break each of these down into greater detail so you can see how they work together in action before deciding whether or not hosting a live event is right for you.

Making Money Through Ticket Fees

When Neil and I host our event, it’ll be free to attend. And I actually don’t recommend that you do that – it’s just what we promised people when we started talking about doing a live event.

On the one hand, guests are more likely to show up if they have some skin in the game from having purchased a ticket. From what I’ve heard, it’s not unusual to have 40-50% of your registered attendees not show up for free events. Even when participants pay ahead of time, a no-show rate of 10-15% isn’t uncommon. Life happens.

Beyond that, running events isn’t cheap. Depending on the type of event you plan to hold, you might need to account for:

- Speaker fees, if you’ll have a headliner or keynote speaker

- A facility to rent that’ll hold the number of attendees you expect

- Tables, chairs and A/V equipment rentals (if they aren’t included in your facility fees)

- Refreshments, whether that’s a coffee bar, boxed meals or a full buffet

- Signage and other printed materials

- Staffing to manage your registration table and other on-site needs

- An event management software program, event app or other logistics tool

Obviously, there’s a lot of variability here. If you want to have a local speaker present to a group of 30 in the meeting room of your local YMCA, your event budget is going to look very different than if you plan to invite one of your industry’s top names to present to thousands at a swanky hotel ballroom.

But for a middle-of-the-road estimate, I usually say that it costs roughly $200-$300 a head to do an event right. Running some quick numbers, that means that if you plan to have 100 people attend, your costs are going to hit right around $30,000. If you go up to 200 people, you’re now looking at $60,000.

If you don’t charge for tickets, you’ve got to recoup that cost somewhere else. But once you start charging for tickets, the revenue you generate in other areas becomes pure profit. Continuing with our example:

- To break even, you’d need to charge $300 per ticket.

- If you charged $500 per ticket, you’re now netting $200 per ticket for a profit of $20,000 on an event with 100 people and $40,000 on an event with 200 people, beyond any revenue you generate in other areas.

- If you bring your ticket prices up to $1,000 per ticket – a price point that’s not uncommon in the marketing world – you net $700 per ticket, creating a ticket-based profit of $70,000-$140,000 per 100-200 attendees.

Personally, I wouldn’t recommend pricing tickets based on your anticipated break-even point, because events almost always cost more than you expect. There’s always some unexpected last-minute expense or fee you didn’t see coming – so plan ahead. Kaitlin Colston of Endless Events recommends setting aside 15% of your planned budget as a “rainy-day fund” to make sure that these unexpected costs don’t tank your profitability.

Learn More: 7 Slick Ways to Get a Hold of Your Leads Through Marketing

Adding Sponsorship Fees to the Mix

If you aren’t making money off of event tickets, your profit might come in the form of the fees that your event sponsors pay you:

Basically, when you run an event, you’re creating a captive audience. And while this captive audience might be made up of your target customers, chances are there are other brands that would like to get in front of your participants as well. That’s where sponsorship fees come in.

There are a number of different factors you’ll need to take into consideration when planning to add sponsors to your event. Chief among them is the need to create sponsorship packages that’ll appeal to any potential sponsors. Bruce Erley, president and CEO of Creative Strategies Group, breaks the benefits of event sponsorship down into three categories when calculating potential fees:

- The tangible value – which he defines as “the quantifiable value of any and all measurable benefits that you are providing to the sponsor.” Examples of this type of benefit might be the face value of 10 free tickets or the market rate for ad space provided as part of a sponsorship tier.

- The intangible value – which is “the qualitative value of being associated with the event.” This is harder to measure, but it’s worth remembering that, if you create a great event, brands benefit by being a part of it.

- The market value – which takes the going rates of different markets and event types into consideration. Understandably, sponsorship packages are going to look pretty different if you’re hosting a high-end seminar in New York City, versus a one-hour lecture in Iowa City.

Taken together, Erley explains, “To determine the fee for a sponsorship, I add together the dollar value of all the tangible benefits a company will receive at a given level of sponsorship, magnify that by the intangible value of association with my event and then factor in any local market pressures either up or down in setting the fee.”

To some degree, you can cut this process short by looking at what similar events have charged sponsors (and what perks they’ve received in exchange). Just be sure that you’re comparing apples to apples. Even if you want to grow your event into one of your industry’s biggest draws, you probably aren’t there yet, so you may not be able to charge what they’re charging.

Finally, keep your costs in mind. Let’s say you’re running a 100-person event for which tickets are $300. Knowing that you’re going to break even on your event costs, you’re counting on sponsorships to make up your profit. But if you give away 20 free tickets to sponsors, that’s $6,000 in ticket revenue you won’t see. Now you’re dipping into your sponsorship earnings so that you can cover your costs.

Learn More: Why All Marketers Should Go to Conference After-Parties

Selling Your Products or Services to Event Attendees

Neil and I like to recommend that either your ticket sales or your sponsorship fees cover your event costs so that the other becomes your profit. However, these aren’t the only way you can make money hosting events.

Thinking of your attendees as a captive audience makes the benefits of selling your products and services to them pretty obvious. In fact, if you look at a lot of the big marketing conferences, you’ll see that they’re put on by product companies in the space, including Moz’s MozCon, Optimizely’s Opticon, and Hubspot’s Inbound conference.

Just look at the numbers on Inbound 2018. According to the event’s website, more than 24,000 people attended the company’s 2018 in Boston, MA.

Average ticket prices for the event range from $199 for the Community Pass up to $2,199 for a VIP ticket (not taking early bird promotion rates into consideration). Although I have no idea how many tickets in each tier Inbound sold, let’s play with the numbers, assuming that they sold equal quantities of each ticket type:

- 8,000 attendees X $199 Community Pass = $1,592,000

- 8,000 attendees X $1,699 All Access Pass = $13,592,000

- 8,000 attendees X $2,199 VIP Pass = $17,592,000

That’s a total of nearly $33 million – just in ticket revenue alone.

Obviously, these numbers could be much higher or lower, depending on sales timing and ticket type distributions. And Inbound certainly isn’t a cheap event to run, as it takes a lot of space and resources to keep 24,000+ attendees happy over a four-day period (my $300 per head estimate is probably way under what it actually takes to produce the event, even though that simple calculation alone comes out to $7.2 million here).

These numbers should clue you into how profitable live events can be. But whether or not Inbound is profitable from its ticket fees, sponsorship packages or exhibitor opportunities isn’t really the point. What likely matters most to HubSpot is the Tuesday afternoon keynote where founders Brian Halligan and Dharmesh Shah get on stage and talk about what’s new with HubSpot – as well as the entire track of sessions dedicated to HubSpot-specific training.

Any attendee who isn’t a HubSpot user is going to spend the event being inundated with the benefits of the company’s tools. If even a fraction of attendees become customers – or recommend HubSpot to others, based on what they learned – that represents a huge potential income stream for the company.

Learn More: Why You Should Set An Agenda & Focus on Team Building at Conferences

Selling Your Event

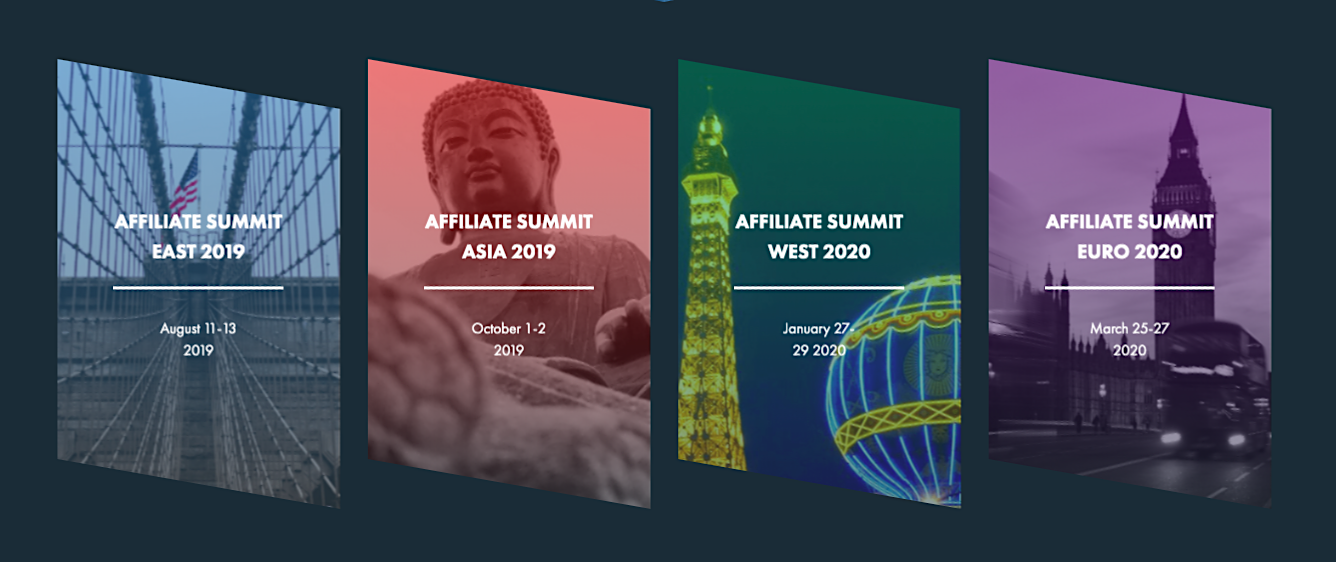

One final potential revenue stream that deserves a mention here is actually selling your event. And although it’s tough to get hard numbers on how much you can make this way, it’s worth noting that there’s demand. Just take a look at the Traffic & Conversion Summit, and the Affiliate Summit, both of which sold to Clarion Events in the last few years.

There’s a lot of upside for a company like Clarion. Based on what I learned about them, they go around buying conferences because they know attendees are super engaged. Then they’re able to take advantage of economies of scale to produce events as profitably as possible by:

- Adding more events (just take a look at how many Digital Marketer has added lately)

- CROss promoting sponsors across different events in order to increase sponsorship revenue

- Locking up local hotel blocks at the bulk rate and reselling them back to attendees through sites like Expedia and Kayak

Is Clarion or another buyer going to be interested in buying your event? Maybe, maybe not. But if you’re trying to build a major conference, think about your exit in the same way you’d think about exiting a startup. If you can’t imagine running the same event for 20+ years, acquisition may be an option.

Mix It Up to Maximize Your ROI

Finally, keep in mind that none of this has to be “either-or.” At our live event in June, for example, Neil and I aren’t charging ticket prices, but we are planning to host an exclusive VIP dinner for 20 attendees. Fees for that could be as much as $2,000 per seat, so we’ll be able to use the revenue that the dinner generates to offset the free tickets – without even taking into consideration sponsorship fees or the opportunity to upsell attendees on our services.

Keep all these different options in mind and get creative! Mix up your revenue generation strategies to make your event as profitable as it can be while still creating an amazing experience for your participants.