Content marketing ROI can be a fuzzy subject. It’s long-term focus and indirect nature can make it difficult to connect the costs to revenues for a business.

That causes a lot of people to undervalue content marketing or write it off as a waste of resources. They have a hard time spending the time and money without revenue numbers to back them up.

On the other side, some companies pour money into bad strategies because everyone keeps telling them “content is king” but they don’t really know what type of content they should be producing.

For example, Coca-Cola’s “Share-A-Coke” campaign was a creative form of content marketing that focused on encouraging their customers to generate and share their own content. It was extremely effective in increasing the conglomerates’ already massive sales by 2% and helped them accomplish a second marketing objective – engaging with customers and deepening their relationship.

But when was the last time you saw a Coca-Cola blog post (yup, that’s actually the second hit on Google for “Coca Cola blog”) in your feed… sure they have one. But they’ve identified the ROI of different content opportunities and budget accordingly.

So you know how to set up an epic content strategy. But because of its broad, hard-to-measure impact, many business managers are skeptical when their marketing teams or contractors insist on allocating more resources to content marketing.

And that’s understandable.

Most other areas of business, heck, even most other areas of marketing are much easier to express in numbers. We spent X, we earned Y. ROI is simple.

So why should they increase your budget when Jake from sales has a successful direct sales campaign in full swing and is asking to hire another sales rep with that same money?

You might not be able to quantify every benefit of content marketing and that’s okay. Jake can’t quantify every benefit in his proposal either. But he does have numbers. You need numbers.

Today, I’m going to show you how you can break down your content marketing efforts to win over managers and clients. To help them understand your value.

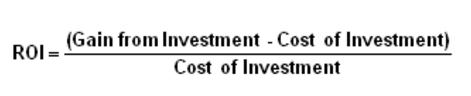

What Is ROI?

ROI is your Return On Investment. Essentially, what are you getting for your money? In business, this is traditionally defined as:

With content marketing, some of that return may be difficult to track. It’s hard to show all the ways great content can increase profit, but you should be quantifying what you can.

That can be really frustrating for writers and marketers because we all know how valuable it can be. In fact, Demand Metric found that on average, lead acquisition with content costs 62% less than traditional marketing. In other words, dollar-for-dollar, content generates nearly 3 times as many leads.

When you present to stakeholders, it’ll be important to talk about both the quantitative and qualitative benefits with them. But for now, let’s focus on how to get the numbers.

Related Content:

* 9 Simple High-ROI SEO Tactics for 2023

* 6 Steps to Prove to Your CEO that Inbound Marketing Can Generate ROI

* Google Analytics for Content Marketing: How to Track and Improve Your ROI

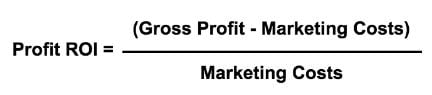

Calculating Content ROI – The Business Way

Regardless of the business objectives, marketing ROI should be calculated as:

What changes is how you define those profits and costs based on your business because with content marketing the profits might not be immediate or direct.

For example, if the content is used for lead generation it may drive zero sales. But that doesn’t mean it isn’t generating profit for the business. Some (hopefully, many) of those leads will go on to become paying customers and we can estimate that value.

The calculations will vary a little for every business – depending on your business objectives and marketing funnel setup.

As an example, I’m going to walk you through how you would calculate ROI for a content blogging strategy focused on generating qualified leads – one of the most common content objectives.

Step 1: Calculate Your Conversion Rate

This is a metric you should definitely already be tracking. It’s best to get the real number by looking at historical data. To keep things relevant, focus on recent data as your conversion rate might change over time.

If you can’t get real data, you can estimate it by looking at the total number of new leads that came in over the last 90 days and dividing it by the number of new customers in that same time frame.

But be careful, if you have a longer sales cycle that extends beyond a month, this might not be the most accurate representation of conversions.

One easy way to correct for this is by shifting your time frame to match the average sales cycle. So if you have a 60-day sales cycle, divide the number of new customers from April-June by your new lead from February-April (two months prior) since those that is the pool of leads responsible for most of the conversions.

Let’s say that you received 1,000 leads in February-April and 100 new customers in April-June. 100 customers for every 1,000 leads gets you a 10% conversion rate.

Step 2: Calculate Your Monthly Content Expenses

If you hire outside contractors or agencies to handle your content, this part can be super easy. Start by looking at your invoice.

Let’s assume that you publish 4 posts a month and pay $200 for each one. Then you tack on some promotion and design costs that average out to about $50 per post.

In total, you’re spending $250 ($200 + $50) for each blog article you publish.

So your monthly publishing costs are $250 x 4 = $1,000.

Then add any additional fixed costs, like blog hosting and software tools you use solely for content marketing. These could be website extensions like Sumo or Leadpages or internal tools used to manage the content publishing process.

For this example, I’m going to say you’ll probably spend around $200 on these things each month. Ignore any sunken costs like website design because they aren’t relevant going forward, you’ve already paid for them.

Add those two together and you get your monthly content budget… $1,000 + $200 = $1,200.

“But we have full-time employees writing our content!”

If you have an internal employee working on content creation, but it’s not their full-time job you can still calculate these costs without too much work. You’ll need to use their real hourly rate to calculate this.

Start with their hourly pay (if they’re on salary, be realistic about how many hours they work in a week… don’t just use 40) but make sure to add overhead too.

Overhead is all the costs like rent, utilities, and insurance that you spend to have them working for in addition to their pay. The easiest way to apply this is to take the total expenses for each of these categories and divide them by the number of employees working in the space.

If your rent is $6,000/mo for 30 employees, you need to add $200/mo to that employee’s monthly cost before you calculate their real hourly rate.

Step 3: Customer Acquisition Cost (CAC)

So far, everything has been simple addition and subtraction. But now we need to step things up. You remember derivatives from your college calculus class right…?

Just kidding.

All you need to do here is find out how many leads your content generates and use your conversion rate to figure out how many of them will likely turn into paying customers.

So if your content generates 100 leads a month and your conversion rate is 10% (from step 1) then… you can expect to receive 10 new customers every month from this content.

Now that you have an idea of how many customers your marketing will add and how much you’re spending to get them, all you need to do is calculate your costs per new customer–your Customer Acquisition Cost.

$1,200 / 10 = $120

Professor Gerard would be proud.

Related Content:

* 15 Fast and Easy Ways to Improve Your Site’s Conversion Rate

* 8 Tools to Help with Conversion Rate Optimization

* SaaS CAC: A Guide to Customer Acquisition Costs

Step 4: Calculate Your Customers’ Average Lifetime Value (LTV)

For many businesses, customers will buy more than once. They’ll return for more merchandise, they’ll subscribe to a monthly service, or fall into another sales funnel for upsells.

Every business should track their customer LTV, but if that info isn’t readily available, you just need to ask two questions:

- How much does the average customer spend in a year?

- How long does the average customer relationship last?

To answer these, just look at sales records and organize them by customer (this is one of the key reasons that grocery stores are always pushing those “points” cards on you and e-commerce stores insist you “create an account”)

When you look at this data you find that the average customer spends about $100 / year on your products and services and that they tend to stick around for 3 years. Obviously, this will vary from customer to customer-what matters is the average value.

That means your estimated customer LTV is… $100 x 3 = $300.

Depending on where you look, you’ll find that some people use profit when calculating LTV and others revenue. Both measures have their purpose, but for this situation, it makes the most sense to focus on lifetime profit.

For example, a SaaS business should subtract the onboarding and similar costs from subscription revenue before settling on the LTV.

Step 5: Calculate the ROI

Now you have real numbers to take to battle. You are spending $120 for every customer you bring in and you expect that they’ll earn the company $300 over their lifetime.

For some managers, this will be enough – they can now quantify the value you are bringing.

But if you really want to take this all the way, you can calculate the actual mathematical ROI too.

Since LTV represents profit and CAC represents costs, we can easily plug them into the formula above.

ROI = (Profit – Cost) / Cost = (LTV – CAC) / CAC

Or in our example…

ROI = (300 – 120) / 120 = 180 / 120 = 150%

Watch Your Assumptions

It’s very important to point out that this final number is highly dependent on a few key assumptions. It’s important to clarify those assumptions and how changes in those assumptions will affect the outcome.

Technically, every data point is an assumption if you’re planning for the future. Unless you have a crystal ball and know that these numbers can be repeated exactly. But the 3 critical assumptions here are:

- Conversion Rate

- Average Annual Profit Per Customer

- Average Length of Customer Relationship

Even subtle changes in these assumptions can dramatically affect the project’s ROI and taking the time to develop accurate assumptions will help your credibility and reliability.

You should spend time talking with your manager or client about these assumptions to make sure they are as accurate as can be and so they can understand the impact of other business decisions they make. Such as an initiative to improve conversion rates.

Conclusion

While content marketing is more than just a sales funnel, having this information will help you be more persuasive in meetings and interview. Knowing your numbers will set you apart from the hundreds of thousands of marketers that “don’t want to do all the accounting stuff.”

Make sure you take the time to show them how you arrived at your conclusion so they understand how you became a professor of economics all the sudden and can make sense of it for themselves.

Yes, it takes a little time to calculate, but it’s nothing overly complicated if you set up a formula and plug in the data. And when paired with its qualitative benefits like improved customer relationships, increased brand awareness, and better organic search ranking it will be hard to deny that your content is getting the job done.

Check out our 8-minute video “How to Do Content Marketing the Right Way in 2023“: