In Chapter 3 of the Ultimate Guide to Blockchain and Cryptocurrency, we’ll share the companies using blockchain marketing successfully. From security tokens to loyalty points, these newcomers on the market are taking advantage of the latest blockchain technology.

Investments in blockchain companies are set to outpace last year – with over 300 investments and over $800M funded in 2017. Check it out:

There are quite a few companies out there that are already making use of blockchain for marketing purposes in a variety of ways. If you’re looking for a blockchain advertising agency, here’s a quick roundup of the most innovative ones.

Brave and the Basic Attention Token

The Brave browser is the next step in ad-blocking software: because it’s able to block trackers and intrusive ads, it’s a much faster browser, and you can even choose to allow ads that respect your privacy.

This software is introducing the Basic Attention Token (BAT), with their aim being to bring the digital marketing model back to the simple framework of users, advertisers and publishers, without the middlemen taking a cut and causing it to be an inefficient and opaque marketplace.

In this video, Brendan Eich (who created Firefox, JavaScript and now Brave) believes that we’re paying up to $23 a month per person to view ads, with our bill going towards bandwidth spent on ads and trackers. The whole aim of the BAT boils down to this:

Why should we be paying to view ads when advertisers should be paying us?

Brave can anonymously track which sites are of interest to you. It works like a cycle: publishers receive tokens when ads are viewed and so do the users who chose to receive and view the ad. From that, the users can choose to donate the tokens back to the publishers they support.

All of this is done using blockchain, making it private and reliable, and providing some insight into the future of advertising.

Babyghost and VeChain

These real-world cases don’t just cover advertising – there are innovative ideas coming into play in marketing as well. Babyghost is a fashion brand that, at Shanghai Fashion Week, worked with blockchain platform VeChain to provide a link between the digital and fashion worlds. VeChain is a service that uses blockchain to verify if an item is authentic or not.

Customers can scan the tag of the Babyghost item and see if it’s genuine or not and can even see a ‘story’ of where it came from and who had previously modeled it. This has created a one-of-a-kind feel to each product and allows the customer to create a personal connection with it.

Used in this way, we can see blockchain tapping into ‘authentic’ advertising that doesn’t even seem like marketing.

BitClave

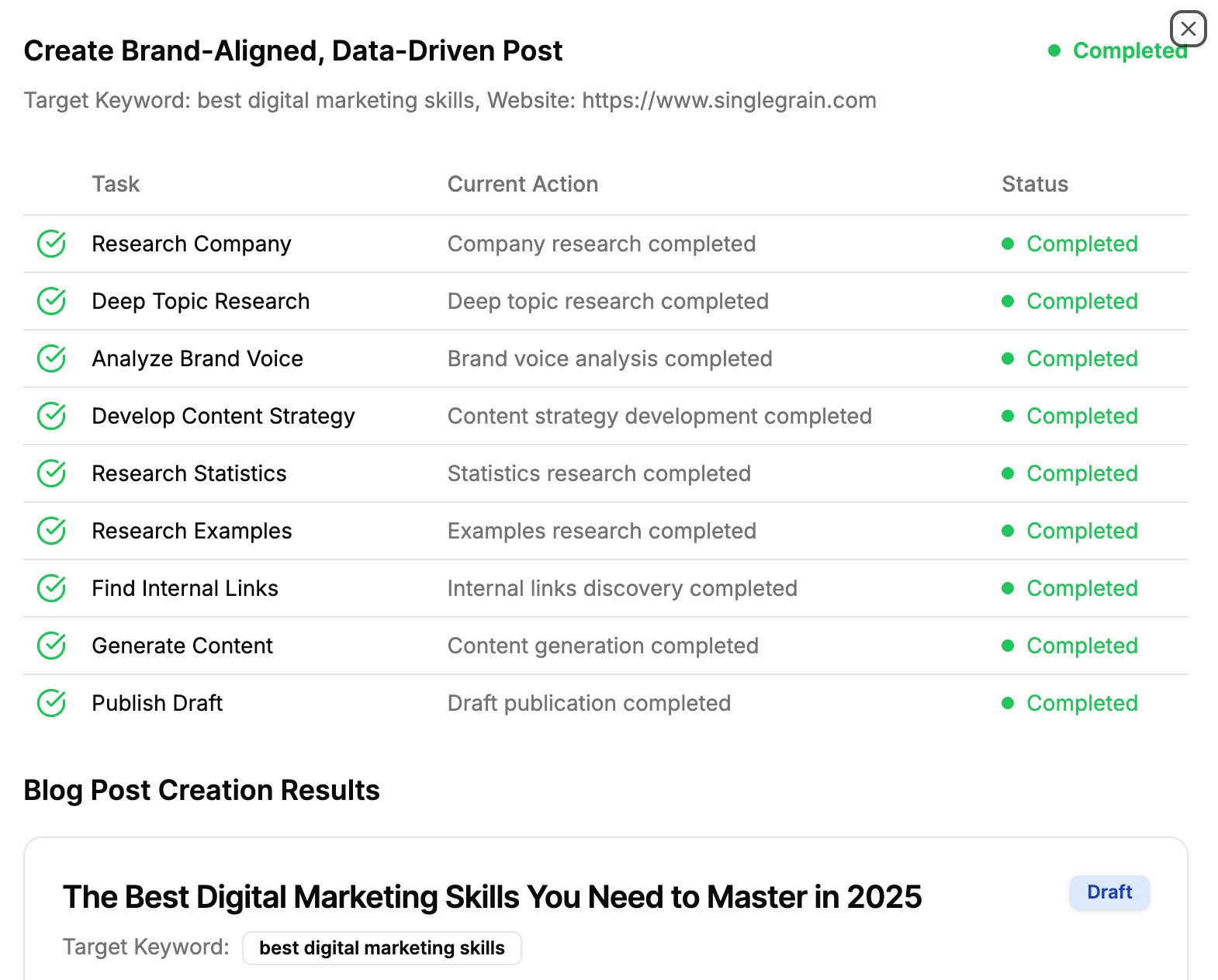

BitClave is a marketing technology company built on the blockchain.

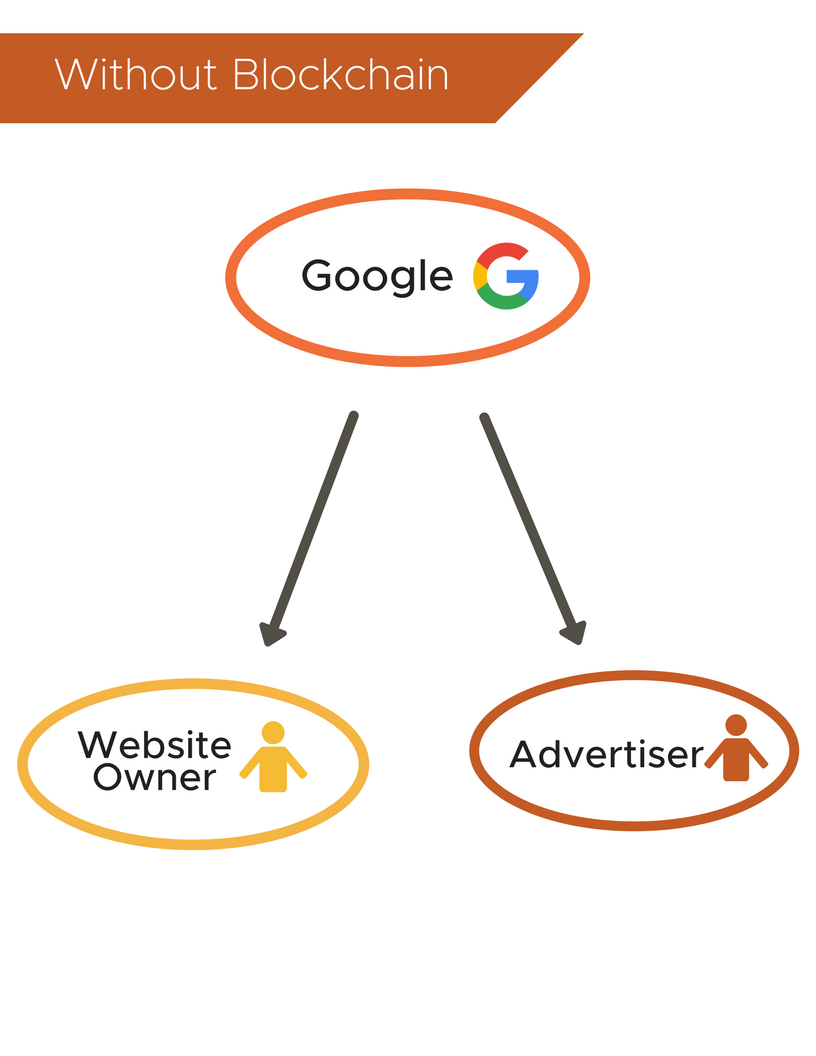

Currently, almost all advertising that marketers do is done through some sort of intermediary. We pay Facebook to run ads to their users. We pay Google to show our web page at the top of search. We pay YouTube to play our videos to a certain group of viewers.

This is how a website owner / advertiser transaction looks like without the blockchain:

Source: Search Engine Land

With the blockchain, website owners and advertisers can communicate with each other directly because users and clicks are automatically validated.

Source: Search Engine Land

BitClave’s premise is that rather than businesses paying high fees to middlemen like Google and Facebook, they eliminate the middleman through the use of smart contracts.

A smart contract is a program that automatically controls the transfer of currencies between two parties. In BitClave’s case, consumers have full control over their own data – without being forced to hand it over to an advertiser. They can choose to sell that data to businesses and opt in to different advertising services.

Polymath

Polymath plays in the security token space.

On the blockchain, there are two types of tokens – utility tokens and security tokens.

Utility tokens are what most people are familiar with. These are things like Bitcoin, Ethereum and Ripple.

Security tokens are an important, but lesser known part of the blockchain ecosystem. They are issued by companies that get their value from an external asset – for example, a venture capital or private equity firm. Investors can buy security tokens like they’d buy shares in a stock, and companies can issue security tokens to raise money for their business.

But the process for launching a security token is costly and time consuming. Token issuers need to make sure that their investors are verified and accredited, and jump through a lot of federal regulations.

That’s where Polymath helps.

Polymath lowers the barrier for security token issuers (i.e. companies) to issue tokens to investors and raise money for their business.

Marketers can leverage this like they’d leverage a platform such as AngelList. Just like AngelList lets you crowdsource funding from investors for a project, Polymath makes it easier to raise investments to expand your business through security tokens.

OrionCoin

OrionCoin is tackling the world of loyalty and reward programs.

Companies use loyalty programs to help increase retention among their customers. For example, a credit card company might offer travel rewards points, or a retail store might offer points for customers who purchase a certain amount of products.

But there are a few problems with how loyalty programs currently operate.

For one, there’s an infinite supply of points. Customers aren’t motivated by scarcity or urgency, which can result in complacency and reduced retention rates.

Points are also not tied to any monetary value. So if a customer doesn’t want any of the rewards that he or she is entitled to with the number of points they’ve accumulated, the points are essentially worthless. Customers are limited by the type of rewards companies offer.

OrionCoin uses the blockchain to supply companies and their customers with loyalty points – which they call “ORC.” There’s a finite number of ORC produced, which means that the more companies adopt OrionCoin, the more valuable ORC will become. And because there’s not an infinite supply of ORC, consumers would be more motivated to accumulate them.

The blockchain also has built-in transparency, which means that OrionCoin cannot artificially reduce the value of their coin to increase profits – like many merchants do today with their loyalty points.

The other problem that OrionCoin tackles is the intrinsic value of each “point.”

Most loyalty programs offer rewards for points that are largely unattainable. For example, a credit card company might let their customers claim their reward for a free flight ticket, but it may take months or even years to rack up that many points.

If customers don’t feel excited at the potential rewards they could get – either because it takes too much time to rack up points or because the rewards offered aren’t appealing enough – then the loyalty program isn’t effective.

With OrionCoin, customers can trade ORC for cash, which means they can spend it on whatever purchases they want. Through the blockchain, the loyalty program would feel less limiting, and could potentially help marketers retain more customers for the long term.

Rouge

Rouge is trying to use the blockchain to change the coupon industry.

This is another industry where there’s a lot of fragmentation and technological limits.

In 2016, there were 307 billion coupons issued by companies, but only 2.2 billion were actually redeemed. When it comes to finding coupons, customers usually have to sift through expired coupons or other coupons that have been promoted but can’t be redeemed.

Rouge is tackling this problem by building a marketplace where brands can issue coupons and users can acquire them. Through Rouge, brands can issue unique coupons and track them – and because the date is coded into the coupon, expired coupons won’t exist online. Coupons generated from the Rouge blockchain can only be used once, so individuals can’t hack the system and create duplicate coupons.

The blockchain also gives coupons additional value, since it opens them up to trading on the secondary market. Customers can share promo deals through a trading marketplace where new customers exist.

That brings us to blockchain and cryptocurrency.