How AI Search Is Changing Brand vs Non-Brand Paid Search Strategy

Your AI paid search strategy is being rewritten by forces outside your account configuration, as AI-driven search results compress traditional ads and organic listings into a new, answer-first experience. AI Overviews, conversational search, and recommendation systems now decide which brands get visibility long before a user ever scrolls to classic ads.

This shift changes the balance between brand and non-brand paid search in fundamental ways. To keep acquisition costs efficient and protect demand you already own, you need a clear view of how AI search alters auctions, query volumes, and click behavior, and a roadmap for restructuring campaigns, budgets, and measurement around this new reality.

TABLE OF CONTENTS:

- The new AI search landscape for paid media

- AI paid search strategy: Brand vs non-brand performance shifts

- The AI-first brand vs non-brand search framework

- Campaign architecture, measurement, and risk in AI-driven search

- Priority playbook for lean teams and agencies

- Future-proofing your AI paid search strategy

- Related video

The new AI search landscape for paid media

AI search is no longer just a lab experiment; it now shapes the default experience on major search engines and emerging assistants. Instead of a clean separation between paid and organic results, users see blended answer modules, generative summaries, conversational follow-ups, and ad units woven throughout.

For paid search, that means fewer predictable “10 blue links plus 3 text ads” scenarios and more fluid layouts where the number, placement, and prominence of ads depend on intent, device, and past behavior. Brand and non-brand queries are both competing for attention in this compressed, AI-curated environment.

How AI-shaped SERPs change the rules

AI Overviews and similar features often answer basic informational queries directly, reducing the need to click anything. For non-brand campaigns that rely heavily on upper- and mid-funnel queries, that can mean fewer impressions, lower click volumes, and more intense competition for the remaining high-intent traffic.

At the same time, commercial and transactional queries still surface ads prominently, but they may now appear above, within, or below generative answers. AI search ad spending is projected to double between 2025 and 2026, reaching $25 billion by 2029. This signals that advertisers are leaning into these new surfaces rather than abandoning search.

Because AI systems decide when and how to show ads, traditional levers like match types and manual bids matter less than the quality of your data, assets, and signals. This is where your overall AI paid search strategy must expand to include feed quality, creative diversity, and first-party audience signals, not just keyword lists.

Where brand and non-brand queries now show up

Brand queries typically retain strong ad coverage because platforms see clear commercial intent and a high likelihood of conversion. However, AI answers may still appear above your brand ad, summarizing reviews, pricing, or comparisons, which can dilute direct navigation and introduce competitors into what used to be your “home turf.”

Non-brand queries, especially broad informational ones, are more likely to be answered fully or partially within AI modules. That reduces traditional ad inventory for some top-of-funnel terms but pushes more value into commercial-intent variations where users signal readiness to compare, shortlist, or buy.

The net effect is that generic “how to” and “what is” terms may drive fewer paid clicks, while more specific solution, category, and product queries gain relative importance. Paid search teams can no longer treat brand and non-brand as symmetric levers; each sits in a different part of the AI-shaped journey.

AI paid search strategy: Brand vs non-brand performance shifts

AI search changes how often different query types surface ads, who sees them, and how users engage with them. That in turn affects volume, CTR, CPC, and conversion rates for brand and non-brand segments in distinct ways.

The table below summarizes directional trends many advertisers are observing as AI features roll out more broadly, especially in markets where AI Overviews or similar experiences are prominent.

| Query type | Volume trend | CTR trend | CPC trend | Conversion rate trend |

|---|---|---|---|---|

| Branded | Relatively stable, some shifts to AI assistants | Slightly lower when AI answers appear above ads | Rising due to defensive bidding competition | Generally stable, where ads still receive clicks |

| Non-branded | Declining for generic informational; stable or growing for high-intent | Lower on purely informational terms; mixed on commercial | Mixed: lower on weak-intent terms, higher on competitive high-intent | Higher concentration of conversions in commercial-intent queries |

Brand protection in generative search results

For branded queries, your main risk is not the disappearance of demand but the erosion of control. AI answers may surface third-party content, competitor comparisons, or outdated information alongside or even before your paid and organic listings.

Cross-industry advertisers profiled in a Search Engine Land overview of 2025 PPC trends responded by shifting spend toward branded keywords and implementing automated bidding rules that prioritize top positions on their own terms while capping bids on lower-return non-brand phrases. The result was higher branded CPCs but steady conversion rates, validating a more defensive posture.

In practice, that means running tightly controlled brand-only campaigns, maintaining substantial impression share, and layering in audiences and scripts that automatically respond when new competitors or resellers begin bidding aggressively on your name.

Non-brand demand when AI answers first

Non-brand campaigns feel AI’s impact earlier and more sharply because so many generic questions can be answered without a click. Many teams report shrinking impression volumes and lower CTR on pure informational terms, while transactional and “best of” style queries retain a stronger ad presence.

As non-brand inventory becomes more polarized between low-value informational and highly competitive commercial terms, your AI paid search strategy should focus on tightly themed, high-intent query clusters. Generic awareness should increasingly be handled through organic content, social media, and other channels that can still win visibility within AI answers.

Aligning that organic and paid work is easier if your SEO team is already thinking about targeting branded versus category-focused keywords in a coordinated way, rather than in separate silos.

The AI-first brand vs non-brand search framework

To move from reactive tweaks to a durable plan, it helps to formalize how you allocate budget and attention between brand and non-brand in an AI-shaped search world. One practical approach is to think in four modes: Defend, Capture, Expand, and Test.

Brand campaigns primarily live in the Defend and Capture modes, while non-brand campaigns spread across Capture, Expand, and Test. Your AI paid search strategy should define how much budget sits in each mode, which levers you allow automation to control, and which you intentionally constrain.

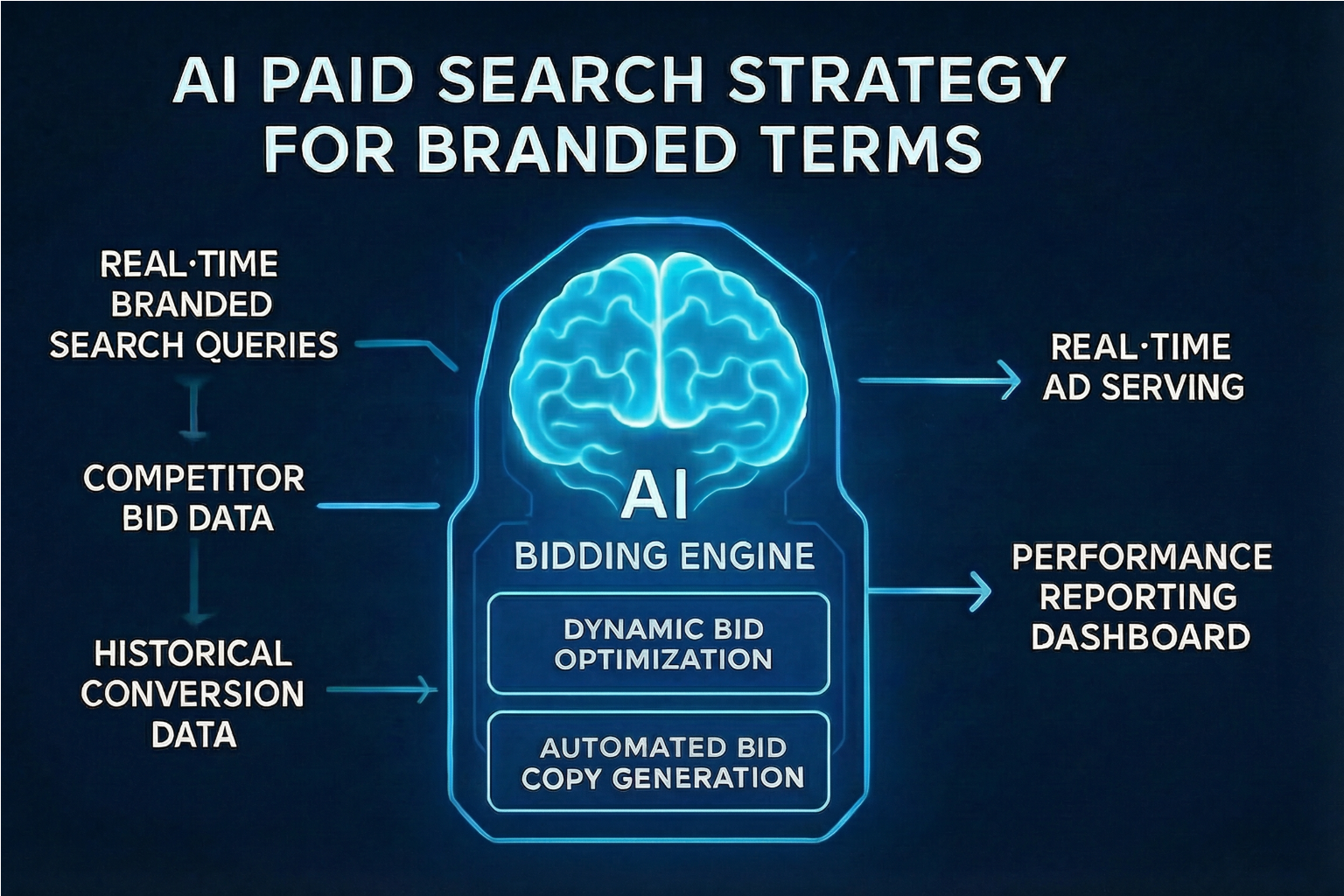

Designing an AI paid search strategy for branded terms

For brand terms, the Defend mode comes first: secure top ad positions on your exact and close-variant brand queries, protect against conquesting, and ensure your messaging reinforces trust when AI answers show mixed information. That typically means separate brand-only search campaigns with conservative match types, strict negative lists, and high but capped target impression share.

In Capture mode, you broaden slightly to include brand and key product or solution modifiers when users are evaluating options or specific use cases. Responsive Search Ads should highlight proof points that both users and AI systems can latch onto, such as review volume, certifications, or longevity, because these can reinforce AI trust signals for brand authority in generative search.

Automation can set bids, but you should closely monitor how it treats competitor terms and partner or reseller queries. Your brand campaigns are the last place you want algorithms to over-expand; guardrails, such as strict negatives on generic phrases, help keep them focused on true brand protection.

AI paid search strategy for non-brand expansion

On the non-brand side, Capture focuses on clearly commercial, solution-aware queries, where AI is likely to show ads alongside or just below generative answers. Here, use structured themes around buying signals, such as “software for,” “services near me,” or “pricing,” and pair them with value-focused messaging rather than basic feature lists.

Expand mode is where you tactically deploy broad match, dynamic search ads, and Performance Max, while keeping an eye on incrementality. Given how AI blends surfaces, you want these campaigns to discover emerging long-tail queries and new variants the moment users adopt them, without cannibalizing your branded search performance.

Test mode handles experimental audiences, new geographies, and fresh creative themes. Rotate limited budgets through these tests to see how AI responds, then graduate winners into your core Capture or Expand structures. This is also the right place to coordinate with SEO experiments, since both are chasing visibility within AI-led experiences; resources like a B2B AI-driven SEO strategy that converts can provide the organic side of that roadmap.

As your framework matures, revisit budget allocations quarterly. If AI features start absorbing more informational demand in your category, you might reduce Test and top-of-funnel Expand spend while increasing Defend and Capture to lock in the most profitable intent clusters.

Once you have clear guardrails for each mode, you can safely lean more on automated bidding and creative rotation, knowing they operate within a structure designed for AI-era constraints and opportunities.

When you are ready to operationalize this across complex accounts, partnering with specialists who live inside AI search platforms daily can accelerate the transition. Single Grain works with SaaS, e-commerce, and B2B brands to align brand protection and non-brand growth under a unified AI paid search strategy. If you want expert input on your current setup, you can get a FREE consultation.

Campaign architecture, measurement, and risk in AI-driven search

AI-driven search doesn’t just affect keywords; it also reshapes how you structure campaigns, define KPIs, and manage brand safety. Ignoring these layers can make strong strategic ideas underperform in practice.

This section focuses on three operational levers: campaign and channel architecture, measurement and attribution, and risk management around AI-generated content.

Structuring campaigns for AI surfaces

Start by separating brand and non-brand at the campaign level across search and Performance Max so you can set different bid strategies, budgets, and creative guardrails for each. This preserves clarity when AI blends performance across surfaces like Shopping, YouTube, and discovery placements.

Within non-brand campaigns, build tighter ad group themes around stages of intent rather than just product categories. For example, keep “best [category] tools” queries distinct from “[category] pricing” so that AI-informed bidding strategies can learn which surfaces and messages work best at each decision stage.

When deciding how much to rely on fully automated campaign types, consider how critical control is for that segment. Brand protection usually warrants more structure and constraints, while non-brand discovery can tolerate more experimentation as long as you measure incremental lift.

Measurement updates for AI-influenced journeys

As AI absorbs more top-of-funnel queries, you may see fewer impressions and clicks without an immediate drop in revenue. That means raw CTR and CPC trends can be misleading if you don’t anchor them to downstream metrics like qualified leads, pipeline, or margin.

A key adjustment is to treat view-through and assisted conversions more seriously, especially for non-brand campaigns that act earlier in the journey. This is where understanding why CTR still matters in an AI-driven search world helps: CTR serves as a signal of relevance for algorithms and users, even if the total number of clicks shrinks.

Plan recurring experiments to compare “AI-heavy” structures, like broad match plus smart bidding, against more controlled setups on a share of traffic. Use holdouts or geo-split tests to determine whether AI-led expansion truly adds net-new conversions or reshuffles attribution across channels.

Risk management and brand safety in AI search

Because AI systems can misinterpret content or hallucinate details, brands face new risks when their name appears in AI-generated summaries of third-party sources. Paid search cannot directly control those summaries, but it can ensure that your official content, landing pages, and ad messaging present clear, consistent information.

Make it standard practice to regularly search core branded and category queries in AI modes, document problematic summaries, and flag them through platform feedback channels when needed. At the same time, bolster your organic footprint with content designed to support accurate AI interpretations.

Your brand and legal teams should also weigh in on negative keyword policies, especially for sensitive categories, to ensure automated campaign types do not associate your ads with misleading or off-brand AI-generated contexts.

Priority playbook for lean teams and agencies

Not every team has a data science department or unlimited testing budget. The good news is that you can still adapt to AI search with a focused, staged approach that emphasizes the most leveraged changes first.

Use this prioritized playbook to organize the next 3–12 months of work around the realities of brand and non-brand performance in AI-shaped search results.

90-day and beyond action plan

- Next 30 days: Split brand and non-brand into distinct campaigns if they aren’t already, add negative keywords to keep brand terms from leaking into non-brand structures, and benchmark current impression share, CPC, and conversion rates by segment.

- Days 30–60: Rebuild non-brand ad groups around clear intent tiers (research, comparison, purchase) and pause low-intent queries that AI Overviews now dominate, shifting that budget into high-intent clusters.

- Days 60–90: Launch controlled experiments with broad match plus smart bidding in a subset of high-intent non-brand themes to see whether automation can uncover profitable new queries despite AI’s changing surfaces.

- Quarter 2–3: Deepen alignment with SEO and content teams so that your keyword research, including questions about whether keywords still matter in the AI search era, informs both AI Overview optimization and paid search expansion.

- Quarter 3–4: Evolve attribution and reporting to emphasize revenue-driven KPIs across search and other channels, and revisit budget splits between brand Defend/Capture and non-brand Capture/Expand based on real performance, not pre-AI assumptions.

For e-commerce or local service brands, add a parallel track focused on product and location data quality, drawing on practices used to improve AI search visibility for product queries. Strong feeds and accurate local information help both organic AI answers and Shopping-style ad units perform better.

Throughout this timeline, keep a living document of “AI impacts observed” so you can brief stakeholders on why branded CTR may fall, why some non-brand volumes shrink, and how your updated strategy protects revenue despite those shifts.

Future-proofing your AI paid search strategy

AI search will keep evolving, but the underlying challenge remains consistent: protect the demand you own on branded queries while profitably capturing and expanding non-brand demand in a landscape where many questions never lead to a click. The teams that win will treat AI not as a single feature to optimize for, but as the fabric of how search now works.

Your AI paid search strategy should therefore be a living framework that balances Defend, Capture, Expand, and Test across brand and non-brand, supported by thoughtful campaign architecture, updated measurement, and deliberate risk management. As mentioned earlier, this requires close collaboration between performance, SEO, and brand stakeholders, not isolated channel optimizations.

If you want a partner to help audit your current setup, model brand versus non-brand budget scenarios, and design experiments tailored to your category, Single Grain specializes in AI-era search strategies that tie every dollar back to revenue. To see how this could look for your business, get a FREE consultation and start future-proofing your paid search investment.

Related video

Frequently Asked Questions

-

How should my paid search creative evolve for AI-driven search results?

Prioritize assets that clearly communicate differentiation and proof, such as customer outcomes, guarantees, or unique use cases, because AI environments compress space and reward clarity. Develop multiple message angles tailored to different intent levels so automation can match the right headline and description to each query context.

-

What changes should I make to landing pages to support an AI-first paid search strategy?

Design landing pages to answer follow-up questions users commonly ask after the initial query, reducing the need for additional searches or chats with assistants. Include structured information such as FAQs, comparison tables, and trust elements so that both users and AI systems can easily interpret your value and intent alignment.

-

How do AI-driven search changes affect budget planning across other performance channels?

Plan paid search budgets in tandem with paid social, display, and retargeting, since AI can shift where discovery and consideration happen. If search becomes more bottom-of-funnel in your category, you may need to fund awareness and education in channels that remain visually rich and less answer-compressed.

-

Are there specific AI-related signals I should feed into my ad platforms to improve performance?

Yes, high-quality first-party signals, such as lead scores, subscription status, and high-LTV tags, help bidding algorithms prioritize the queries and users that matter most. Integrating these signals through offline conversion imports or API connections lets AI optimize beyond simple last-click conversions.

-

How does AI search impact B2B versus e-commerce paid search strategies differently?

B2B brands often see longer journeys with more research steps, so AI experiences can compress early-stage education and make mid-funnel queries more valuable. E-commerce brands, by contrast, need to emphasize product-level relevance, availability, and pricing, as AI assistants increasingly shortcut users directly to purchase-ready options.

-

What skills should my team develop to stay effective in AI-influenced paid search?

Emphasize analytical experimentation, audience and data management, and cross-channel collaboration over manual keyword tweaking. Team members should be comfortable designing controlled tests, interpreting ambiguous results, and working closely with analytics and SEO to influence how AI understands and surfaces your brand.

-

How can I monitor whether AI assistants are cannibalizing or complementing my paid search results?

Track changes in query mix, assisted conversions, and branded direct traffic alongside your paid search metrics to see where journeys are shortening or shifting. Combine this with periodic audits of AI assistants and chat interfaces for your priority keywords to understand how often they route users toward or away from your site.