How Predictive Churn Models Cut Customer Loss by 40%

Customer churn is the silent profit killer that keeps growth-stage executives awake at night. While you’re focusing on acquiring new customers, existing ones are quietly slipping away — often without warning. The solution isn’t just better customer service or loyalty programs. Your solution is predictive churn models that identify at-risk customers before they leave, giving your team the power to intervene with surgical precision.

Recent data from 2024 shows that 46% of surveyed B2B SaaS companies have already integrated predictive churn models into their retention workflows. These aren’t just early adopters; they’re companies that understand the difference between reactive customer service and proactive revenue protection.

Key Takeaways

- Predictive churn models deliver measurable business impact, with companies typically seeing 20-40% reductions in customer churn within their first year, while advanced models achieve 97.30% accuracy in identifying at-risk customers.

- Early intervention transforms retention from reactive to proactive by analyzing behavioral indicators like login frequency, feature usage, and support patterns to flag customers before they actually churn.

- Implementation requires unified customer data and automated interventions to consolidate information across CRM, support, and billing systems while connecting predictions to specific actions like personalized outreach or retention offers.

- Continuous model optimization prevents performance degradation through quarterly retraining and monthly performance reviews to address concept drift as customer behaviors evolve over time.

- More businesses are using this technology, with 46% of B2B SaaS companies already implementing predictive churn models, making immediate adoption critical for avoiding competitive disadvantage.

TABLE OF CONTENTS:

Understanding the Predictive Power Behind Customer Retention

Why should businesses implement churn models in the first place? This technology recognizes patterns that show a prospect is at risk of churning, or not converting into a customer. Unlike traditional analytics, which tell you what has happened, these models forecast what is about to happen, giving you the critical window needed for intervention.

Predictive churn models function as your early warning system, identifying those most likely not to make it down the sales funnel. SaaS companies can also utilize predictive churn modeling to identify which subscribers are at risk of canceling or downgrading their subscriptions.

The technology combines historical customer data with machine learning algorithms to generate risk scores. These scores consider dozens of behavioral indicators: login frequency, feature usage, support ticket patterns, payment history, and engagement trends. When a customer’s behavior shifts in ways that historically precede churn, the model flags them for immediate attention.

“The difference between knowing a customer churned and knowing they’re about to churn is the difference between an autopsy and prevention surgery. Predictive models give you the scalpel.” – Customer Success Executive, Fortune 500 SaaS Company

Modern ensemble approaches are achieving remarkable accuracy. A peer-reviewed 2024 study demonstrated that advanced models can identify churners with 97.30% accuracy and 93.76% ROC-AUC performance. This technology is what transforms retention from guesswork into science.

The Momentum Behind Industry-Wide Adoption

The adoption curve for predictive churn models has accelerated dramatically. Beyond the 46% of SaaS companies that are already implementing these systems, momentum is building across industries. 80% of bank executives view generative AI for predictive analytics as a major advancement for reducing customer attrition.

This isn’t just about keeping up with competitors; it’s about changing how businesses think about customer relationships. Companies using predictive models shift from reactive “save” campaigns to proactive “nurture” strategies. They identify customers showing early warning signs and address underlying issues before dissatisfaction crystallizes into churn.

The theoretical benefits become concrete when you examine actual implementations. Consider the transformation at a growing B2B SaaS company that was struggling with rising monthly churn and inflated customer acquisition costs. After implementing a machine-learning predictive churn model that integrated with their customer success and marketing workflows, they achieved remarkable results: monthly churn dropped to 4.2%, customer acquisition cost fell 58%, and net revenue retention climbed to 125%.

The telecommunications industry provides another compelling example. Verizon deployed generative AI-driven predictive models that analyze customer intent across their 170 million annual service calls. The system now understands the intent behind 80% of incoming calls, enabling agents to resolve issues before dissatisfaction triggers churn. The projected impact is staggering: more than 100,000 customer losses prevented annually.

| Industry | Implementation Result | Key Metric Improvement |

|---|---|---|

| B2B SaaS | Monthly churn reduced to 4.2% | 58% reduction in CAC |

| Telecommunications | 100,000+ annual churn prevention | 80% call intent recognition |

| E-commerce | Significant CLV improvement | Marked repeat purchase increase |

Your Implementation Strategy Roadmap

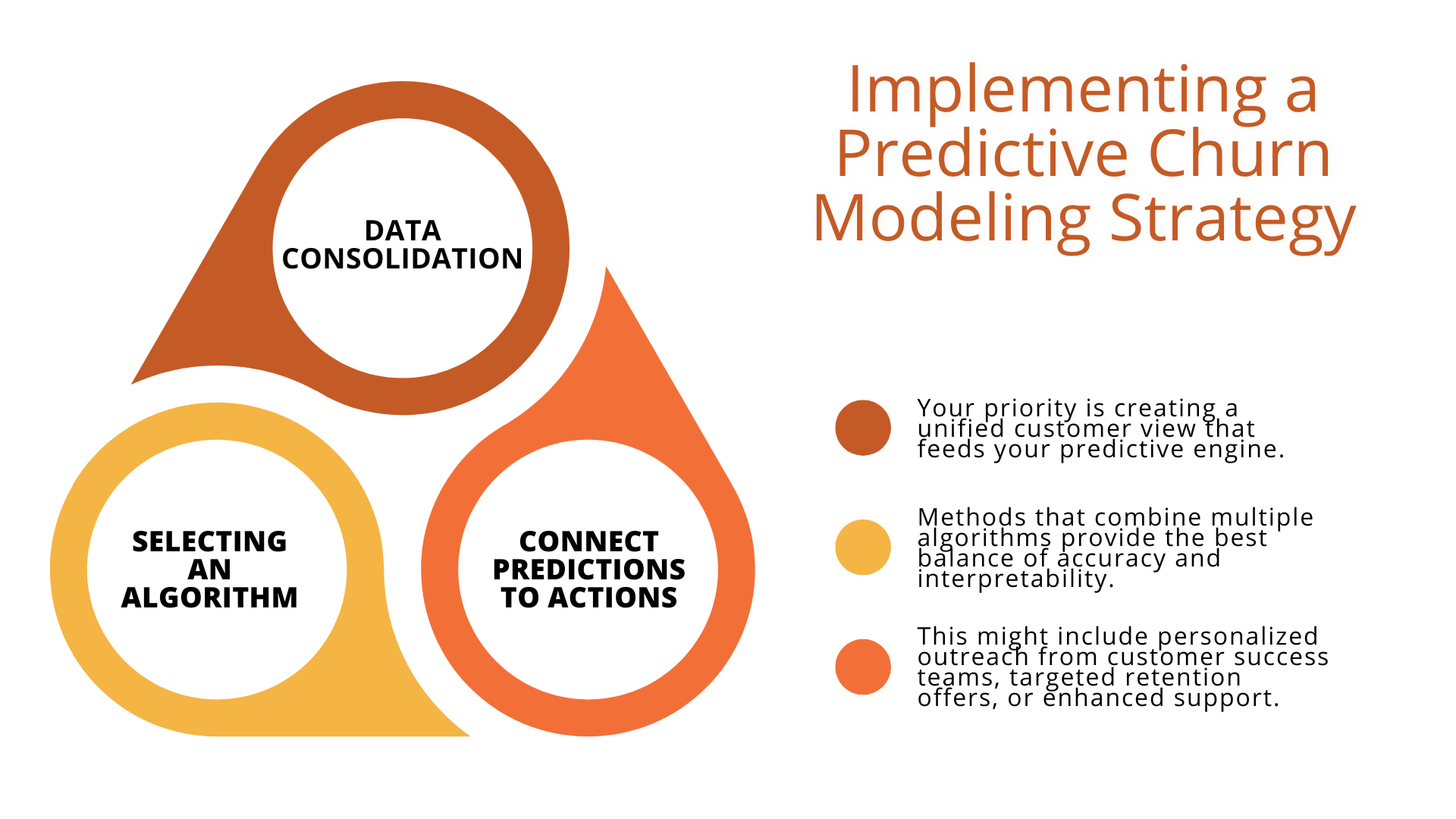

Successfully deploying predictive churn models requires more than just technology; it demands an approach that aligns data science with business operations. The foundation begins with data consolidation. Most companies have customer information scattered across CRM systems, support platforms, billing databases, and analytics tools. Your first priority is creating a unified customer view that feeds your predictive engine.

The next critical decision involves selecting an algorithm. Machine learning approaches vary significantly in their complexity and accuracy. For example, neural networks handle unstructured data effectively but require larger datasets and more computational resources. For most growth-stage companies, methods that combine multiple algorithms provide the best balance of accuracy and interpretability.

The real value emerges when predictions connect to actions. High-risk customers shouldn’t only generate alerts, but also trigger specific, automated interventions. This might include personalized outreach from customer success teams, targeted retention offers, or enhanced support. The key is creating feedback loops that continuously improve both your predictive accuracy and the effectiveness of your interventions.

Measuring ROI and Continuous Optimization

Predictive churn models generate measurable returns across multiple dimensions. The most direct impact appears in reduced churn rates, but the benefits extend to improved customer lifetime value, more efficient retention spending, and enhanced team productivity. Conversion rate optimization principles apply here. You’re optimizing the conversion from “at-risk” to “retained” rather than from visitor to customer.

Monitor your model performance through precision, recall, and F1-score metrics. But don’t stop at technical accuracy. Track business metrics like retention rate improvements, revenue impact per prevented churn, and the cost-effectiveness of your intervention campaigns. The most sophisticated models become worthless if they don’t translate into measurable business outcomes.

Model performance degrades over time as customer behaviors evolve. Schedule quarterly model retraining and monthly performance reviews. Watch for concept drift, which is the phenomenon where the patterns your model learned become less relevant as market conditions change. Companies that maintain long-term success with predictive churn models treat them as living systems, requiring continuous care and improvement.

Transforming Retention Into Sustainable Growth

High rates of customer churn can eat into your profits. But instead of watching potential customers slip before your eyes, it’s best to prevent churn in the first place. This is where predictive churn models come in. Businesses can be aware of patterns that signal a lost prospect or existing customer, and organizations can implement various tactics to maintain their relationships with that lead or buyer. Predictive churn models not only identify who might leave, but also who might be ready to upgrade or expand their usage.

As we move deeper into 2025, the organizations that prioritize customer retention will have a clear advantage. Predictive churn models provide the foundation for this transformation; however, success requires a commitment to data quality, operational excellence, and continuous improvement.

Ready to transform your customer retention strategy? Partner with the leading CRO agency that combines data science expertise with practical implementation experience to help growth-stage companies achieve measurable improvements in retention.

Ready to stop losing customers to competitors who’ve already gone predictive?

Frequently Asked Questions

-

What behavioral indicators do predictive churn models analyze to identify at-risk customers?

Predictive churn models analyze dozens of behavioral indicators, including login frequency, feature usage patterns, support ticket history, payment behavior, and engagement trends. When a customer’s behavior shifts in ways that historically precede churn, the model flags them for immediate attention with risk scores.

-

How accurate are modern predictive churn models in identifying customers who will leave?

Advanced predictive churn models can achieve up to 97.30% accuracy in identifying churners with 93.76% ROC-AUC performance. These high accuracy rates transform retention from guesswork into a data-driven science, enabling precise intervention strategies.

-

What data sources need to be integrated for effective predictive churn modeling?

Successful implementation requires consolidating customer data from CRM systems, support platforms, billing databases, and analytics tools into a unified customer view. This is essential for feeding the predictive engine and generating accurate risk assessments.

-

How long does it typically take to see results after implementing predictive churn models?

Companies typically see 20-40% reductions in customer churn within their first year of implementation. The most immediate impact appears in reduced churn rates, but benefits extend to improved customer lifetime value and more efficient retention spending.

-

What specific actions should be triggered when a customer is flagged as high-risk?

High-risk customers should trigger automated interventions such as personalized outreach from customer success teams, targeted retention offers, or enhanced support. The key is creating feedback loops that connect predictions to specific actions and continuously enhance the effectiveness of interventions.

-

How often should predictive churn models be retrained and updated?

Schedule quarterly model retraining and monthly performance reviews to maintain accuracy. Model performance degrades over time due to concept drift, where learned patterns become less relevant as customer behaviors and market conditions evolve.

-

What ROI metrics should companies track when measuring predictive churn model success?

Track business outcomes, including retention rate improvements, revenue impact per prevented churn, and cost-effectiveness of intervention campaigns. The most sophisticated models become worthless if they don’t translate into measurable business results.