Rich vs wealthy: In a world where appearances often overshadow substance, it’s easy to fall into the trap of acting rich beyond one’s means.

Many individuals who find themselves making decent to great money tend to spend it extravagantly as if money were an infinite resource. However, this approach can quickly lead to financial ruin and an unsustainable standard of living as maintaining such a lifestyle becomes increasingly challenging.

In this post, we’ll explore the difference between being rich vs wealthy and how adopting a healthy, entrepreneurial perspective about money can pave the way to long-term financial success.

Spending Habits and Financial Success

It is not uncommon to encounter people who make impressive incomes but struggle to build wealth or even maintain their financial stability.

The key difference lies in their spending habits. Many individuals fall into the trap of spending money excessively, trying to keep up with a certain lifestyle or to show off their perceived wealth. However, this behavior is detrimental to their long-term financial well-being.

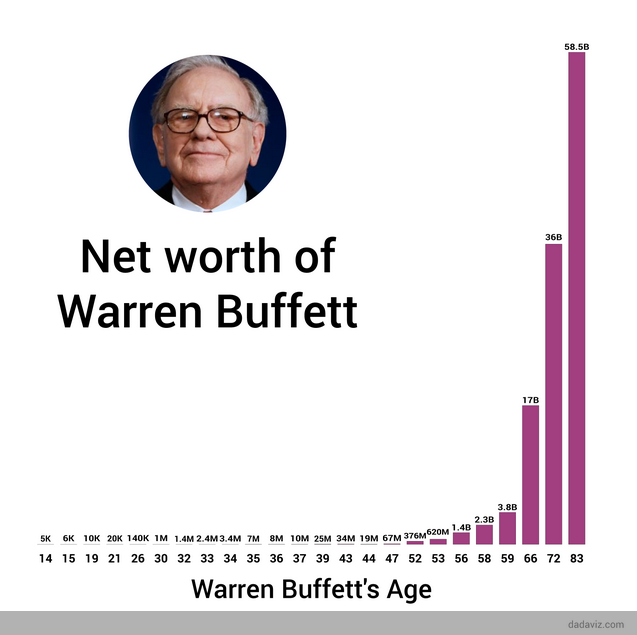

Consider the examples of Bill Gates and Warren Buffet, two of the world’s wealthiest individuals. Despite their vast fortunes, they do not engage in excessive spending to prove their wealth. They understand the importance of living below their means and making wise financial decisions:

Warren Buffet, in particular, is known for his frugal lifestyle, still residing in the same house he bought years ago. Through exercising restraint in spending, these wealthy individuals set an example of the importance of financial prudence.

Wealthy Mindset: Building Value and Investing

A wealthy mindset goes beyond the desire to display material wealth. It focuses on creating value for oneself and society as a whole.

Wealthy individuals grasp the fundamental truth that true financial success stems from strategic investments and fostering the growth of their businesses. They recognize that building wealth is a gradual process, demanding unwavering discipline and meticulous financial management.

In Warren Buffet’s case, he is someone who has embraced a wealthy mindset:

:max_bytes(150000):strip_icc():format(webp)/buffetts-road-to-riches-503bf79a9c444047840ea156fd648143.png)

His remarkable success story did not materialize overnight; rather, it unfolded over years of astute investment decisions and unwavering patience.

Suffice it to say that we can stand to learn a thing or two about managing and growing our wealth if we listen to Buffet’s sage advice.

The Dichotomy Between Rich and Wealthy

While the terms “wealthy” and “rich” are often used interchangeably, there is a fundamental distinction between the two concepts.

Understanding this difference is essential to grasp the mindset shift required for long-term financial success.

Let’s take a look at the contrast between being wealthy and being rich:

Being Rich

Being rich typically refers to having a high net worth or substantial financial resources. It often involves displaying material wealth and indulging in extravagant purchases — individuals who are rich focus on accumulating assets and experiencing a high standard of living.

They may be driven by the desire for external validation and the need to compare themselves with others. However, being rich does not necessarily guarantee long-term financial security or fulfillment.

Being Wealthy

Being wealthy transcends the external displays of affluence associated with being rich. It encompasses a more holistic and sustainable approach to financial success.

Wealth is not solely measured by the size of one’s bank account but by the ability to generate and preserve wealth over time. Wealthy individuals prioritize creating value, making a positive impact on the world, and building a lasting legacy.

The truly wealthy understand the importance of strategic financial management, intelligent investments, and disciplined decision-making.

They focus on building assets that generate long-term growth, such as businesses, real estate, and investment portfolios. Wealthy individuals prioritize financial independence, making their money work for them, and aligning their resources with their long-term goals.

While being rich may be characterized by external displays of wealth, being wealthy centers around creating a solid financial foundation, fostering personal growth, and generating value for oneself and others:

Wealthy Habits and Financial Independence

Developing healthy habits around money is crucial for achieving financial independence and longevity.

Instead of squandering money on unnecessary indulgences, the wealthy prioritize intelligent investments that generate long-term growth. Those who adopt these habits and make them their own will ultimately shift their focus from short-lived pleasures to sustainable wealth accumulation and security for the future.

Building wealth requires a shift in mindset.

It involves moving away from chasing instant riches and embracing a more strategic approach to finance. It means investing in personal growth, continuously learning, and identifying opportunities that align with long-term financial goals.

Last Word on Rich vs Wealthy

It’s vital to recognize that acting rich is not the path to lasting financial success. While it’s perfectly fine to indulge in luxuries if it brings genuine happiness, true wealth is built on a foundation of discipline, intelligent investing, and a focus on creating value for both yourself and others.

Part of adopting a healthy mindset concerning wealth includes breaking free from the cycle of extravagant spending and working toward long-term financial security.

Emulating the habits of successful individuals like Warren Buffet and Bill Gates allows us to gain insights into how the truly wealthy approach their finances and navigate the path to prosperity.

Remember, financial success isn’t about keeping up with appearances or outspending others — it’s about making prudent decisions, investing wisely, and ultimately creating a positive impact on both our lives and the world around us.

Repurposed from our Marketing School podcast.