How New Tariffs Might Affect Your Digital Ad Budget

In light of recent news, implementing new tariffs has sent ripples through the business world, making digital marketing budgets often among the first casualties. As companies grapple with increased costs and uncertain market conditions, understanding how these tariffs might impact your digital advertising strategy is crucial for maintaining a competitive advantage and marketing effectiveness.

Key Highlights

- Budget Pressure: 94% of advertisers are concerned about tariff impacts, with most expecting 6-20% budget cuts

- Channel Shifts: Traditional and social media likely to see largest cuts, while performance-based channels may prove more resilient

- Strategic Pivot: Brands shifting from growth-focused to efficiency-focused advertising strategies

- Opportunity in Crisis: Some experts advocate maintaining ad spend while competitors retreat to gain market share

- Tactical Approaches: Performance-based models, flexible contracts, and data-driven optimization becoming essential

TABLE OF CONTENTS:

The New Tariff Reality

The recent implementation of a 10% baseline tariff on all imports into the U.S., with significantly higher rates for specific countries (including a staggering 84% on Chinese imports), represents one of the most sweeping trade policy changes in recent history. Unlike previous tariff episodes that targeted specific industries, the breadth of these new measures means few businesses will remain untouched—and marketing budgets are already feeling the squeeze.

For digital marketers, this isn’t just a supply chain headline anymore. These tariffs are actively reshaping demand, targeting capabilities, spending patterns, and ROI calculations across the digital advertising ecosystem.

The Scale of Impact on Digital Ad Budgets

The numbers paint a concerning picture. According to recent research from the Interactive Advertising Bureau (IAB), 94% of advertisers are worried about how these tariffs will impact ad spending. More specifically, 60% anticipate budget cuts of 6% to 10%, while more than one in five expect deeper cuts of 11% to 20%.

These concerns have already influenced industry projections. Advisory firm Madison and Wall recently cut its forecast for U.S. advertising revenue growth this year to 3.6%, down from the 4.5% predicted just a few months ago in December.

Historical precedent gives us some context. During the 2018-2020 U.S.-China trade war, auto ad spending fell by 7%, and retail ads dropped by 5%. However, the 2025 situation differs in several critical ways:

- The breadth of tariffs is far more extensive

- Consumers are already sensitized to price increases after recent inflation

- A tight labor market limits companies’ agility in making supply chain adjustments

- Ongoing geopolitical tensions add additional complexity

How Different Ad Channels Will Be Affected

Not all digital advertising channels will feel the impact equally. According to industry analysts, traditional media and social media advertising are expected to face the largest budget reductions, while connected TV (CTV) and online video may demonstrate more resilience.

“Tariffs potentially create a dual impact — increased costs that may squeeze advertising budgets, but also greater need for targeted advertising as brands compete on factors beyond price,” explains Jonathan Gudai, CEO of Adomni, in a recent CNBC interview.

This dual pressure is driving a shift toward more flexible, performance-based advertising models. “In this period of uncertainty, we’re seeing a significant shift toward more flexible, performance-based advertising models that allow brands to adjust spending quickly if conditions change,” Gudai notes.

For retail media specifically, the impact is already visible. Many Amazon sellers have started cutting back on pay-per-click (PPC) advertising spend as one of their first responses to offset tariff-driven margin compression. This could potentially dampen Amazon’s years-long trend of consistently growing ad investment.

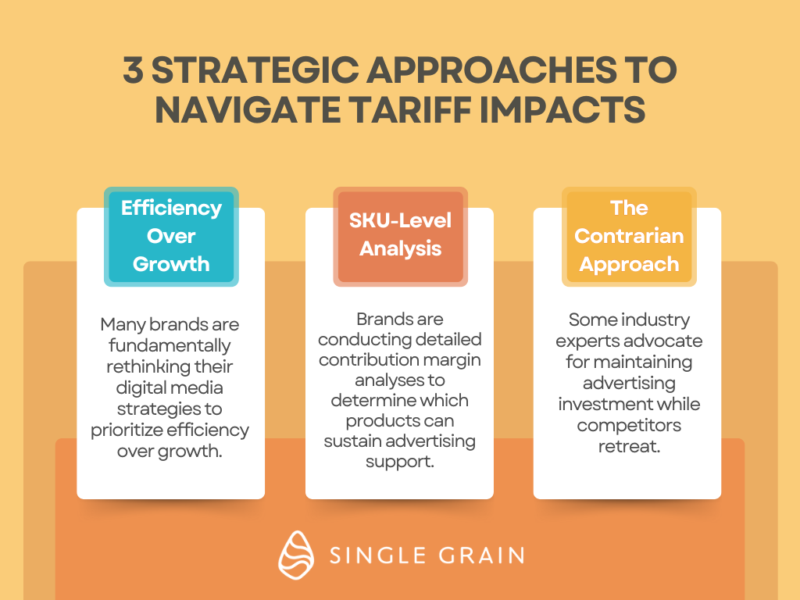

Strategic Approaches to Navigate Tariff Impacts

As brands navigate this challenging landscape, several strategic approaches are emerging:

1. Efficiency Over Growth

Many brands are fundamentally rethinking their digital media strategies to prioritize efficiency over growth. This represents a significant shift for direct-to-consumer brands that have historically used digital advertising primarily to drive customer acquisition and market share gains.

E-commerce recruitment specialist Harry Joiner suggests brands should reserve ad inventory “for known winners and margin accretive products” while deprioritizing broad brand campaigns in the immediate term. His framework emphasizes that visibility and margin protection matter more than brand building during the initial response period.

2. SKU-Level Analysis

As tariff impacts vary significantly by product category and sourcing location, brands are conducting detailed contribution margin analyses to determine which products can sustain advertising support.

“Audit SKU-level tariff exposure (10–34% increases), starting with top-velocity items,” Joiner advises, adding that brands should “re-forecast post-tariff contribution margin by channel.” This data-driven approach allows companies to concentrate remaining ad dollars where they’ll generate the most efficient returns.

3. The Contrarian Approach

While many brands are cutting back, some industry experts advocate for maintaining advertising investment while competitors retreat.

“Now is the time to grow your market share while competitors are scared,” argues Jason Landro, co-CEO of digital marketing agency Nectar. Rather than automatically reducing spend, Landro suggests brands “don’t cut back on ad spend” but instead “get hyper efficient without taking steps backwards.”

This approach requires a renewed focus on advertising efficiency through conversion optimization rather than simply reducing investment. “You focus on improving your conversion rates. You attempt to increase click-through rates,” Landro explains, identifying the tariff disruption as a potential opportunity for prepared brands.

Practical Steps for Digital Marketers

For marketers looking to navigate these challenging waters, several practical steps can help maintain effectiveness while managing budget pressures:

- Hold steady on high-performing channels: Prioritize channels that consistently deliver ROI. If others pull back, you may gain share at a lower cost-per-click.

- Let behavior and data guide next steps: Monitor performance metrics closely and be prepared to adjust strategies based on real-time data rather than assumptions.

- Test messaging adjustments: Consider testing “Made in the USA” messaging if applicable, or develop messaging that addresses consumer price sensitivity.

- Prepare for auction volatility: Expect higher competition in Google Ads and Meta’s ad auctions as advertisers adjust strategies, potentially driving up cost-per-click (CPC).

- Invest in owned and earned media: Grow and activate your email/SMS list, double down on SEO and evergreen content, and consider using influencers for cost-effective creative as production budgets tighten.

- Negotiate flexible contracts: Seek more lenient agreements with media partners that allow you to pivot budgets quickly or shift focus to different types of marketing as you react to changing conditions.

Looking Forward

While the immediate impact of tariffs may create budget pressures, forward-thinking marketers can use this disruption to refine their approach. By focusing on efficiency, leveraging data for decision-making, and maintaining strategic investments while competitors pull back, brands can emerge from this period with stronger market positions.

For personalized advertising that maximizes ROI during these challenging economic periods, tools like Karrot.ai can help transform your LinkedIn ads with 1-1 personalized messaging that actually converts. By delivering individualized messages without sacrificing scale, Karrot helps you make every advertising dollar work harder—exactly what’s needed in today’s tariff-impacted landscape.

Brands that will thrive despite tariff pressures view this period not just as a time for cuts, but as an opportunity to become more strategic, data-driven, and customer-focused in their digital advertising approach.