Are you splashing the cash on advertising campaigns that never seem to pay off? A low ROI isn’t just a vanity metric. If you’re not generating as much (or more) cash than you’re spending on your campaigns, it’s not a sustainable way to grow your business.

It might be time to switch off your poorly performing advertising campaigns in favor of affiliate marketing. One report found that 16% of all online orders are generated through affiliate marketing.

In this guide, we’ll explain the step-by-step process you can use to capture that huge spend. We’ll also discuss how to recruit affiliates for your business — and, more importantly, get sales from your partners so you can grow faster (without having to spend money on increasingly expensive online ads).

What Is Affiliate Marketing?

Before we dive into the details, let’s iron out exactly what affiliate marketing is. Here’s a simple definition:

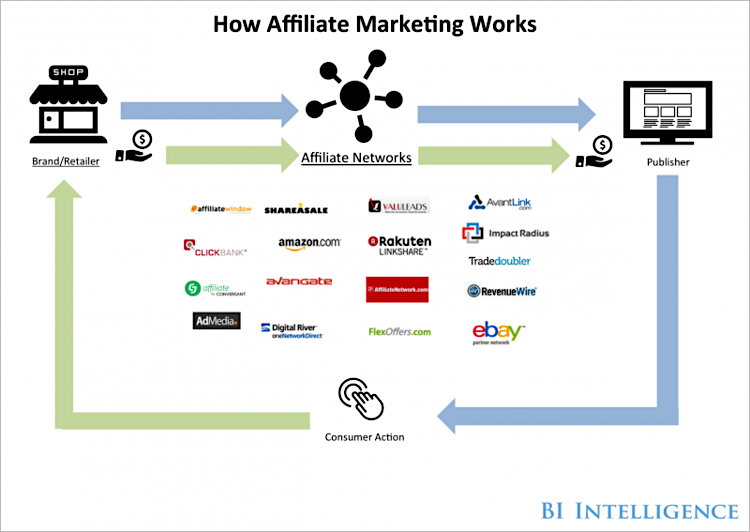

Affiliate marketing is the process of finding people who will refer your products or services to their network, and receive a small commission for every sale they make. Click To TweetThink of it as your own army of brand evangelists who get paid when you do. As Business Insider illustrates it:

This type of marketing is so popular that people build businesses using affiliate techniques as their main source of income. Websites like Groupon, TopCashback and MoneySavingExpert all generate money when their audience purchase products they’ve recommended.

But what happens on the business’ (or merchant’s) side — the companies using those affiliate powerhouses to push their products or services to a huge audience and reward the website with commission? The huge bonus is that they only pay commission to their affiliates when they actually make a sale.

Unlike advertising (where you could spend thousands of dollars for a small volume of conversions), you only pay a set commission figure to your affiliate when a product has been sold and the money from the sale is in your bank. That means you know exactly what you’re spending, your profit margins on each product, and you don’t pay customer acquisition costs upfront.

AlanLaFrance of Lawnstarter adds that:

“You also can earn significant SEO value from affiliates placing links. While Google sometimes rewards this with penalties, it is heavily gamed across the board. In fact, many affiliate marketing setups are simply to earn links and improve organic rankings rather than the actual revenue gain of the program.”

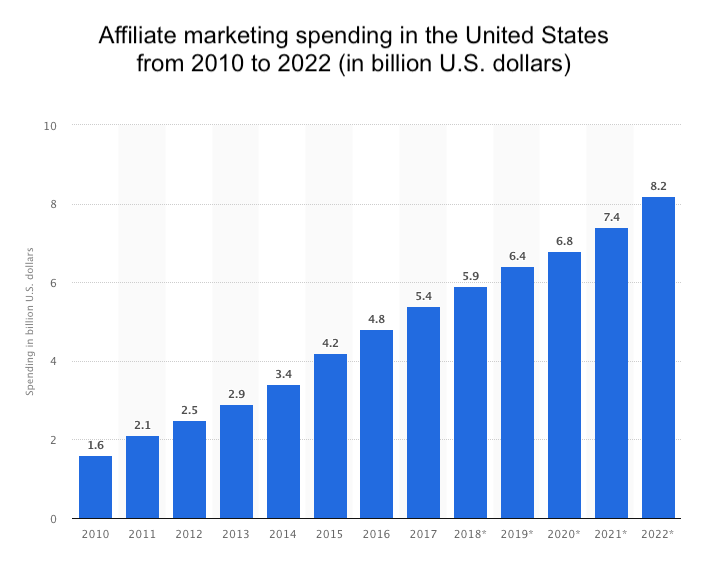

There’s a reason why 81% of brands have created their own affiliate marketing strategy (including Amazon, Net-a-Porter, Nike and Bloomingdales), and spend is predicted to reach $8.2 billion by 2022, up from $5.4 billion in 2017:

Here are several other reasons why you should consider affiliate marketing:

- Searches for “affiliate marketing” grew 30% in one year

- 20% of publishers’ annual revenue is generated through affiliate marketing

- The most popular affiliate marketing categories are fashion, sports, health/wellness

- $7M in affiliate marketing was produced by one influencer in a single year

Dive Deeper: Why Affiliate Marketing Is a Great Option for Startups

How to Start an Affiliate Program for Your Business

Now that you’re fully aware of the benefits of business affiliate marketing programs, let’s discuss the seven-step strategy you can use to build one.

1) Incentivize People to Become an Affiliate

Affiliate marketing is based around incentives. If people aren’t given a reason to actively promote your product, you’ll struggle to generate sales from your affiliate team. That’s why you’ll need to set a commission rate for your affiliates — the percentage of revenue they’ll earn for each product they sell.

The average commission rate falls anywhere between 5% and 30%. However, it’s tough to say what commission percentage you should give to your affiliates because every industry is different.

Let’s take a look at some popular affiliate programs for a handful of different industries and the commission they offer:

- Auto Barn (automotive): 8% commission on every sale

- Net-a-Porter (e-commerce): 6% on net sales, excluding shipping, taxes and returns

- BigCommerce (SaaS): 200% of their first monthly payment or $1,500 per enterprise customer

You can find the most appropriate commission level for your partners by looking at the competitors in your specific industry. Are they giving 40% commission for the first sale or 5% of monthly recurring revenue that they generate for the lifetime of the customer they’re referring? You’ll want to set your commission somewhere in between (or above) the average.

This is a double-edged sword, though. Set your commission too low and you won’t find affiliates motivated to promote your product. But set your commission percentage too high and you run the risk of damaging your profit margins.

Once you’ve perfected your commission percentage, you’ll also need to decide how you want to pay your affiliates. This could be:

- One-off: You pay the commission per sale — best-suited to e-commerce companies. For example, if an affiliate sells a $40 product with a 10% commission, you’ll pay them $4 when the sale goes through.

- Recurring: You pay the commission monthly — best-suited to subscription-based companies (such as SaaS or membership websites). For example, if an affiliate sells a subscription to a customer for $100 per month and they receive a 10% commission, you’ll pay them $10 per month until the customer they’ve referred cancels their subscription.

Cookie Periods

During this stage of your affiliate program set-up, you’ll also need to decide on the cookie period that qualifies an affiliate for commission. This simply means the number of days between an affiliate referring a customer and the customer making the purchase.

For example, if your cookie period is 30 days but the customer purchases on day 34 after clicking the affiliate’s link, they won’t be eligible for commission.

Again, take a look at the cookie periods your competitors are offering and try to position your timeframe within a similar period. Then take a look at your average sales journey. If your affiliates are promoting a low-cost product (like a hairbrush, for example), the time from viewing to conversion won’t be too long. Therefore, your cookie period could be 30 days.

However, if your affiliates are promoting a high-cost product (like B2B software), the audience they’re targeting might take longer to pass through your marketing funnel. It’s unfair to set the cookie period for your affiliates at 30 days if you know that 90% of your customers purchase within 40-60 days, so use that guideline as your cookie period.

2) Join an Affiliate Network

Once you’ve nailed the terms and conditions for your affiliate network, it’s time to build a model that allows you to accept invitations and makes it easy for your partners to promote your products.

There are two models you could opt for:

- Affiliate program: These are managed by your in-house team and affiliates sign up to become a partner through your website.

- Affiliate network: These are huge networks that handle the application process for you and allow people already subscribed to their network to become an affiliate for you.

Stuck on deciding which to go with?

An affiliate program can be more beneficial in the long-term because you completely own your network. They’re not a third-party group of people who might never have bought your products before.

However, affiliate networks are the best starting point. They have an existing community of affiliates looking for deals, people who are experienced in selling products as an affiliate. You also don’t need to manually vet everyone who applies to become a partner. Plus, they act as a mediator between you (the merchant) and your affiliates.

For that reason, we’d recommend starting with an affiliate network such as:

As we touched on earlier, the networks you’re joining will partner you with affiliates and manage their commission. You can also upload branded materials that your partners can use to promote your products, such as unique images, email messages or social media videos.

Wondering how these affiliate networks make money? Affiliate networks act as a mediator between both parties. They’ll introduce you to a group of affiliates already on their platform, and you’ll pay for their services by either:

- Paying a fee to the network (similar to your affiliates commission but usually much lower) for every sale you make through their platform

- Paying an upfront “activation” fee to start using their network

- Paying a processing fee for every time you receive affiliate revenue or pay your partners

Double-check the charges associated with the affiliate network you plan to join before signing up. You’ll need to make sure you’re not sacrificing your profit margins to start using affiliates for product promotion.

Related Content: 7 Creative Ways to Monetize Your Podcast

3) Actively Look for Partnerships

Once you’re set up on your affiliate network, you don’t have to rely on their audience to build your army of partners. You can actively search for people who are already selling similar products in your space and invite them to become an affiliate.

To do this, start by finding people who sell similar products. Can you find a way for them to add your product on the backend? It could be an upsell or a downsell — or even an integration with their product.

Syed Farhan Raza explains how you can find those potential affiliates:

“Go plug in your search term on Instagram search. Look for the profile of people who are promoting stuff you also have in your store or may be in the same niche. Review their profiles and make sure they are not your direct competitors but promoting other store’s products or recommending them anyway. You can do the same on Twitter.

Go to Google and find out blogs in your niche who published reviews on products similar to yours. Again, make sure they are not your direct competitors.”

These people make the perfect affiliates because a simple tweak to their workflow could generate a huge number of affiliate sales.

Let’s put that into practice and say you’re looking for affiliates to promote your organic candle wax. You find a website that sells courses on how to create DIY candles. The person running that course would make a great affiliate because:

- They already have an established audience with an interest in your products

- The people buying their course are more likely to purchase your organic candle wax because it’s something they need for the course

The affiliate generates commission on top of their standard course sales, and you generate more revenue from the customers they bring in. It’s a win-win for everyone involved, right?

Related Content:

- How to Sustainably Build Quality Links by Building Relationships

- How to Work with YouTube Influencers to Grow Your Business

4) Meet Affiliates Directly

Whichever marketing or advertising strategy you’re using, you’ll need to factor in time to stay updated. Things change constantly — and a strategy that works now won’t always be future-proof.

That’s why you need to go meet affiliates directly and see what’s happening in the industry. There are lots of events and conferences you can attend, such as:

Granted, attending affiliate-related events can be a huge time (and cash) investment, especially if you’re traveling to attend. But it’s worth it.

As we mentioned earlier, your affiliates need an incentive to promote your products, and a relationship could sweeten the deal. The moment you get to know some of these people, they’re much more likely to drive traffic (and sell your product).

5) Hire an Affiliate Manager

You’ve built your affiliate program and you’ve got a steady stream of people applying to promote your products in return for a commission. Feeling stressed? It’s time to hire an affiliate manager.

If you try to run an affiliate program on your own, you’ll quickly fall into the trap of accepting every affiliate that applies to promote your products, and that’s not always a good thing. You need to be strict with the affiliates you accept because accepting dodgy affiliates — those who want to make money from everything and don’t genuinely care about your products — could start putting your work on dodgy websites (like porn sites). That won’t do any favors for your reputation, nor your SEO strategy.

But an affiliate manager handles all that for you. They’ll vet your affiliates before accepting them as partners, manage payments, and attend the events we just spoke about.

Having a single person to “own” your strategy makes it easier for people to build relationships with your partners, too. They’ll know who to email when they have a question and get valuable feedback that could help your program become more successful. Isn’t that the goal?

Unsure of whether to hire an in-house Affiliate Program Manager (APM) or an Outsourced Program Manager (OPM)? Check out this comparison chart from Consorte Marketing:

6) Track Affiliate Programs with Software

An affiliate manager will handle the payments you’re sending and receiving from customers and affiliates, along with the network you’re using.

You can make their lives easier by using third-party software to manage payouts, such as:

Sure, a spreadsheet can work for small-scale affiliate programs. But people make mistakes — and you don’t want affiliates to rant on social media that their commission hasn’t been paid accurately for the sales they’ve made.

Third-party affiliate program software solves that problem. They’re usually automated, so payouts are made accurately on time, every time — even if your affiliate manager is off sick or on vacation.

Related Content:

- How to Grow Your Business With Influencer Marketing and Brand Partnerships

- What Is Buzz Marketing?

- 12 Best SaaS Marketing Tactics for Business Growth

7) Remember that Your Affiliates Are People

The saying “a company is only as extraordinary as its people” applies to your affiliates, too.

It’s important to make sure that you’re not treating your affiliates as objects. They are people, your partners. They’re not lower than you. They’re basically working side by side with you, working together to reach the same goal. So the better you treat them, the further you’re going to go with that relationship.

Plus, it’s worthwhile to remember that your affiliates can decide at any time to go work with your competitors because they’re not tied to you. They don’t need to rely on you as their main source of income; they can build all the assets and then just move somewhere else.

However, if you treat them like royalty — with above-average commissions, timely payouts, and taking their feedback onboard — they’ll stick around and promote your products forever.

Final Thoughts

Are you ready to build an army of affiliates to make more product sales? Whichever industry you’re in, you can benefit from affiliate marketing.

Remember to position your commission rate generously (without sacrificing profit margins), pick an affiliate network that will do the legwork for you, and actively find people who will make great partners. You’ll see a bunch of new customers in no time!